In a short time, there will be endless "rumors of death" in 4S stores, and the law of the jungle will still play out.

Last month, the major car companies have been released financial results. From the data presentation, no matter in Japanese, German or American, "kui" becomes the main melody. Obviously, it is not only the main engine factory, but also the automobile circulation industry affected by coVID-19.

Recently, listed dealers have released financial reports for the first half of 2020. Among the 10 mainstream listed dealers that have been disclosed in the reporter's statistics, 7 enterprises including China Grand, Zhongsheng and Yongda have all seen varying degrees of decline in total revenue, and only 3 have achieved an increase in revenue and net profit. In terms of sales volume, only 2 dealers achieved growth.

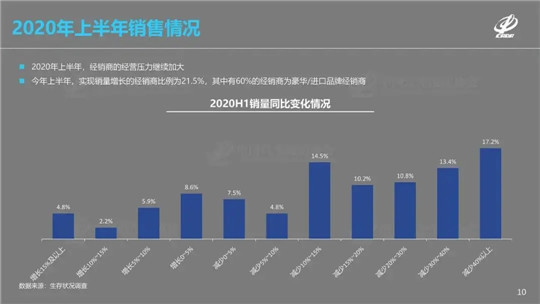

Eighty percent of sales are down, and less than thirty percent of profits

According to the Survey report on the Living Conditions of Auto Dealers released by the China Association of Automobile Dealers (HEREINAFTER referred to as the Report), only 21.5 percent of dealers achieved sales growth in the first half of this year, of which 60 percent were dealers of luxury/import brands. Sales of another more than 30 percent of dealers fell more than 30 percent year on year. This means that the trend of differentiation in the car market is obvious, and the mainstream luxury brands still maintain the momentum of rapid growth. For example, in the first half of 2020, the sales of the company's luxury brands increased 5.7 percent year on year to 111,653 units, accounting for 56.6 percent of the group's total sales, a significant increase from the same period in 2019.

In terms of profit, 38.3% of dealers reported a loss in the first half of this year, 32.9% were flat, and 28.8% reported a profit. In addition, after experiencing the negative new car gross margin for the first time in 2019, the new car gross margin further fell to -3.5% in the first half of this year, aggravating the situation of "sales means loss". Although auto manufacturers have introduced corresponding support policies for dealers to ensure their normal operation, the proportion of loss-making dealers is still relatively high.

The results of 10 mainstream listed dealers in the first half of 2020 show that only Meidong Automotive and Pang Da Group achieved sales growth, with sales growth of 7.9% and 7.98% respectively compared with the same period last year. Only three companies achieved positive growth in operating income and net profit, namely Zhongsheng Group, Meidong Automobile and Pang Da Group, with year-on-year revenue growth of 1.4%, 23.5% and 6.72% respectively, and net profit growth of 9.8%, 28.5% and 103.54% respectively.

Clearly, the direct cause of the dealers' losses was a drop in car sales. China's passenger car market sold 7.7m vehicles in the first half of this year, down 23 per cent year-on-year, according to the Federation. What makes it even more difficult for dealers is "price inversion" (where the dealer's terminal price is lower than the manufacturer's wholesale price). In the first half of 2020, the number of dealers with price inversion accounted for 83.7%, and 79.9% in 19 years. Among them, the price inversion phenomenon of joint venture brands is still quite serious. According to the China Association of Automobile Dealers, the transaction prices of joint-venture brands have been falling due to the double pressure from the declining prices of luxury brands and the upward price of high-end models of self-owned brands.

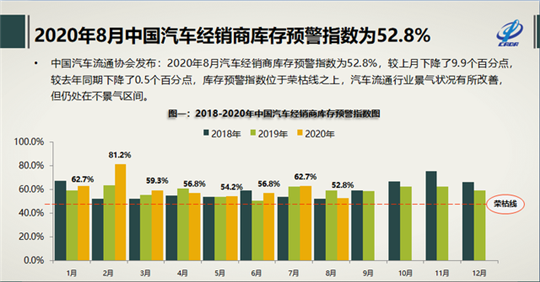

Investigate its reason, dealer inventory pressure is one of the root causes. Since the beginning of this year, the dealer inventory warning index has remained above the warning line, and in June and July when the domestic auto market wholesale sales grew rapidly, the dealer inventory warning index increased instead of decreasing, which means that the inventory is further increasing.

According to the latest "Inventory Warning Index Survey of Auto Dealers in China" released by The China Association of Automobile Dealers, the inventory warning index of auto dealers in August 2020 was 52.8%, down 9.9 percent from July and 0.5 percent from the same period last year. The inventory warning index is above the line that separates expansion from contraction. Although the auto industry has improved, it is still in the doldrums. Some dealers said that the main engine factory had a high target and could not get full rebate. In addition, the market price dropped quickly, so the operation risk was high.

More than a thousand back network, dealer satisfaction continues to decline

Under the combination of multiple pressures, some dealers have already had financial problems. On August 24, Rundong Automobile issued a public notice, saying that the company received a notice that a creditor had filed a bankruptcy reorganization application against Rundong Automobile Group to xuzhou Intermediate People's Court of Jiangsu Province on August 20, 2020. It is reported that the bankruptcy reorganization application is mainly aimed at Rundong Auto failed to repay the balance of 1.659 million yuan and interest, the creditors claim that rundong Auto since July 19, 2019 overdue payment.

With just over one million dollars in debt, this player, who had been in the Top 20 of the "Top 100 dealers" list, was plunged into a capital chain crisis, which took the industry by surprise. Similarly, the same thing happened to Zhengtong. Zhengtong motor, the first luxury car dealership group to list in Hong Kong, had a far more glittering past than Rundong, but in the second half of this year it was revealed that it had to sell its stake because of hundreds of millions of dollars in debt.

Once the halo is no longer, and with Rundong automobile, zhengtong car has a similar fate of the dealer there are many. The total number of passenger car dealers in the first half of 2020 was 29,773, down 0.7 percent from the end of 2019, according to the report. Among them, the number of dealers who chose to withdraw from the network was 1,019, and 824 newly authorized dealers were added, with 195 net outflow of the industry. However, it is worth noting that the dealers counted this time are still the outlets of traditional automobile enterprises, excluding the outlets of new power enterprises such as Tesla, Nextev and Weimar.

At the same time, dealer satisfaction continues to decline. Relevant surveys show that in the first half of 2020, the overall satisfaction of dealers continues to decline, with a score of 76.0, down one point compared with that of last year. In addition to a series of problems such as inventory, which are often mentioned, the main reason is that the business policy is not flexible enough and the operation status of dealers is not sufficiently considered.

When it comes to brands, luxury/imported brands have the highest satisfaction score (84.3 points), while self-owned brands continue to decline (71.2 points), which also shows that some enterprises have relatively single product lines and are slow to respond to market adjustments.

Among all indicators, the brand value of dealers declined the most. Although manufacturers have made policy adjustments in consideration of the impact of the epidemic, the adjustment period is still short, and the improvement effect on the overall operating conditions of dealers is not very significant. In terms of brand value index, dealers have the lowest score on the latitude of profitability satisfaction, just as mentioned above, mainly because the task index issued by manufacturers is too high and dealers are under great inventory pressure.

Lang Xuehong, deputy secretary general of The China Automobile Dealers Association, pointed out that the Matthew effect in the automobile industry is becoming increasingly obvious, and some weak brands inevitably face delistment. Therefore, dealers' attention to the explanation and improvement of the withdrawal mechanism in the brand authorization contract is rising rapidly. It is true that the satisfaction with dealer protection in the current contract is low, so dealer satisfaction has declined. At the same time, dealers have more feedback on manufacturers' bundling sales, which also causes aversion of dealers.

As for the forecast of the whole year in 2020, the survey conducted by China Automobile Dealers Association shows that only 29% of dealers think that the annual growth can be achieved, while 43% think that the negative growth of the automobile market is above 15%. Therefore, China Automobile Dealers Association made a preliminary judgment on the channel network, that is, the channel network will be phased adjustment, it is very likely to shrink the network.

As mentioned above, for this year's car market direction, most car dealers are not optimistic. 2020 is clearly going to be a tough year for the auto industry. At present, we still do not know, under this big change, each big dealer ushered in the fate of elimination or "Phoenix nirvana" after the rebirth. But what is certain is that, for a short time, there will be endless "death stories" and the law of the jungle will continue to play out.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!