The essence of red and black, merit and fault is still taking and giving up under the management philosophy. Toyota has become the model of the industry in the second revolution of the industry, so in the current overall transformation of the auto industry, how to learn from Toyota and avoid warning, this powerful neighbor has become the best reference for Chinese auto companies.

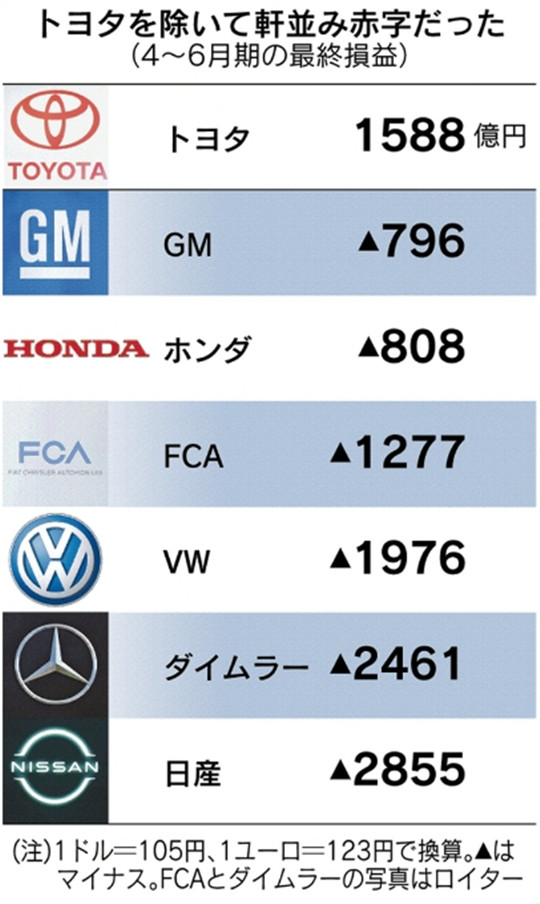

Covid-19 epidemic is at its peak, almost all auto companies have the same wish, the financial results can "fail" as soon as possible. But with the latest figures for April-June published horizontally through August, it is not many manufacturers that have been able to jump above the loss-making line.

Europe and the United States suffered "collective losses", the leader Volkswagen has entered the most difficult time in more than 80 years, the account is very ugly, Ford and GM's many core indicators are not satisfactory; Among recent Japanese players in Japan, only Toyota and Suzuki made a profit, and a slumping Nissan posted its worst loss in 11 years.

Given a range of uncertainties, even a barely loss-free Suzuki is still afraid to give a forecast for the full fiscal year and, despite a tentative profit, has a tougher fight ahead in the second half. That is why, amid the global outcry, only Toyota seems to have qualified for this round of the performance race.

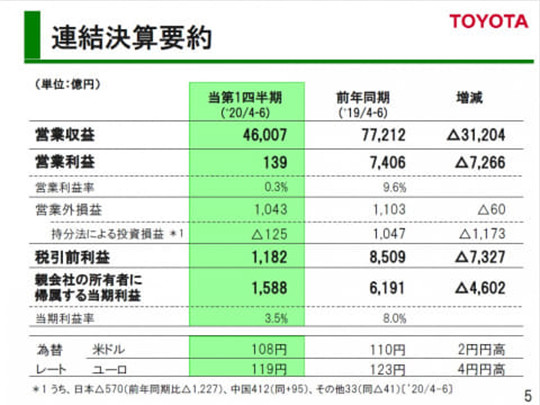

According to Toyota's results for the first quarter of 2021 (April-June 2020), operating revenue nearly halved to 4.6 trillion yen (about 303.2 billion yuan), down 40 percent from a year earlier. Operating profit was 13.9 billion yen (910 million yuan), a fraction of the 740.6 billion yen (48.8 billion yuan) earned in the same period last year.

In announcing its latest quarterly figures, Toyota also forecast a profit for the current fiscal year of 500 billion yen (32.4 billion yuan), down 79% from a year earlier, while global car sales are expected to fall 13% to 9.1 million vehicles. Both profits and sales will be at their lowest levels in nine years.

In the 10 years before the outbreak of the subprime mortgage crisis, Toyota had been running all the way on the racetrack, basically increasing production at the level of 500,000 vehicles per year, ignoring the internal cost reduction and efficiency increase, and unable to better focus on the technical strength of products. In the fiscal year of March 2009, when the subprime mortgage crisis ended, Toyota sold 7.56 million vehicles, down 15% from the same period last year. Its operating profit lost 461 billion yen (about 29.9 billion yuan), and its production, sales and earnings both suffered heavily.

Through more than 10 years of institutional strengthening and internal reform, Toyota relying on the TNGA structure has far surpassed the subprime crisis in terms of risk resistance. So how has Toyota managed to buck the trend in the midst of the global car mess? Under the shadow of coVID-19, where is Toyota's confidence in setting an annual profit target of y500bn?

Parts subsidiaries are getting tougher

As early as the end of 2019 press conference, vice President of Toyota river and has full foreign admits his anxiety to the company, Toyota authors presented the trend of decreasing year by year, the effect of removal of raw material market change, from cost reduction effect of divided by the number of sales "bike cost effect", has become more and more obvious difference with other competitors.

Toyota has reduced costs by about 250 billion yen in the March 2019 period and around 250 billion yen in the March 2020 period. Compared with the previous figure of more than 300 billion yen per year, it seems to lack momentum. Because operating profit is determined by multiple factors such as sales volume, exchange rate and sales bonus, and the effect of cost reduction has been somewhat moderated, it may cast a new shadow over medium - and long-term earnings.

But there was another side to the profit dilemma.

Denso and Aixin Seiko, as parts suppliers of Tier 1 and controlled by Toyota, have been caught in the dilemma of declining earnings in recent years. The performance of these Tier 1 suppliers has gradually deteriorated, which is bound to affect the downstream suppliers of the second and third subcontracting. At a crucial stage in the transition to modernisation, Toyota is slowly subcontracting out units that have little to do with its core business, having moved from semiconductors and internal combustion engines to denso.

Because of this, Toyota lightly, development costs can be without any concerns into the core field of creating value and profit, and those "" the abolition of the repeat business" banner of the supply chain to change, its essence is will be transferred to the downstream of the pyramid of anxiety in the profitable parts suppliers, layer upon layer pressure, until the limit "being sucked dry".

With COVID-19 at its peak, how did Toyota win one of the industry's rare passing grades in a tough environment with first-tier factories shutting down and global sales nearly halving?

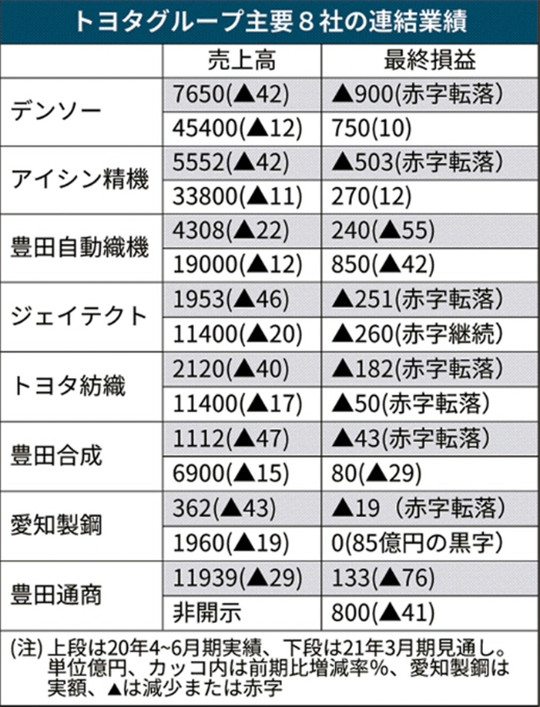

Supplies and orders from Toyota's parts units are also stagnating at a time when Toyota and other non-group customers continue to cut production, according to the company's most recent results for The April-June period. All six companies except Denso and Aixin are expected to post a profit deficit for the full fiscal year, compared with a record deficit of 90 billion yen (5.9 billion yuan) in the april-June period.

The Nihon Keizai Shimbun newspaper ran a series of reports in late July on Toyota's resistance to the virus and on the company's cuts in component supply prices. According to Toyota's purchasing practice, it conducts 1-2 times of purchase price adjustment negotiations with upstream parts suppliers every year, usually arranged in April and October. However, the price reduction happened suddenly this year, which is very rare after the subprime crisis.

Although Toyota officially cited lower prices for raw materials as the reason for the price hike, the company has had business relationships with about 40,000 parts companies so far, and the impact of the price cut may be exacerbated by the coVID-19 outbreak, further worsening the performance of upstream dealers.

But it is worth mentioning that, compared with the March 2009 fiscal year after the subprime crisis, Toyota's parts subsidiary has made significant progress in its ability to withstand risks.

Go back a decade, as Toyota's new-car sales collapsed and inventories at its parts units ballooned. In order to survive in the economic crisis, these subsidiaries were eager to sell high inventory of parts and components, and then the price collapse directly led to further deterioration of earnings, and finally fell into a vicious circle of losses.

After the trauma of a decade ago, Toyota's parts companies learned their lesson and strengthened more flexible production systems. Toyota Tsusho, for example, is expected to post full-year profits of 80 billion yen (5.2 billion yuan), down about 40% from a year earlier but almost double the March 2009 level during the subprime crisis.

Increase revenue and reduce expenditure

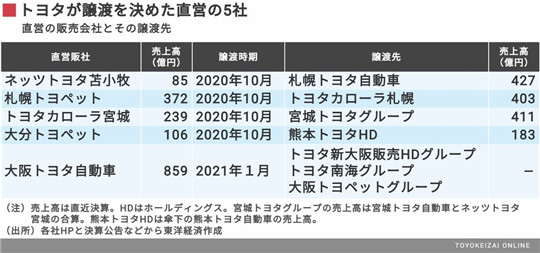

Under the strain of the outbreak, Toyota not only pushed its cost-cutting skills to the limit from its suppliers, but also began to cut costs faster from its dealers. As is well known in the industry, Toyota's internal reform has entered a very critical deep water area, and the depth of the reform, and in the sales channel shows most incisively and vividly.

Since 1956, Toyota has had a complex network system in the Japanese domestic market. Even after the merger of "Vista" and "Netz" in 2004, there are still four brands/sales networks of "Toyota", "Toyopet", "Corolla" and "Netz", providing differentiated products to different audiences. But Toyota's new-car sales volume in Japan has fallen in the past few years as its network strategy has aged.

In order to boost sales, the company decided to gradually abolish the mode of selling limited models by store type and replace it with the new logic of selling all kinds of models in a single store, so as to improve the sales concentration of hot models and high-profit models. That means customers will be able to buy all of Toyota's models at any of its outlets across the country.

In July, Toyota sold its five fully-funded direct-sales companies to local subsidiaries in regions such as Osaka prefecture and Hokkaido. So far, Toyota has been pushing for the sale of direct-sales companies. For Toyota, which is revving up its internal reforms, it was only a matter of time before the sale of direct sales companies was cleaned up. But such a sudden and massive sale of many sales companies has something to do with the company's current performance pressure.

Compared with the subprime crisis, North America is a bright spot at the moment.

According to Toyota period the forecasts for the whole year in March 2021, the company will maintain 500 billion yen (about 32.7 billion yuan) the operating earnings forecasts, to 730 billion yen (about 47.8 billion yuan) net profit, with a 460 billion yen loss in 2009, compared to the three-month operating profit is expected to improve 1 trillion yen (about 65.5 billion yuan).

The biggest contributor is the best-selling SUV in North America. Back in the second year after the subprime crisis, Toyota had a deficit of about Y310bn in North America, accounting for 67 per cent of its Y460bn loss, compared with just Y230bn in Japan and Y140bn in Europe.

The biggest change in North America has been a further increase in sales of higher-margin suVs and pickup trucks. According to research firm Merkrains, Toyota will sell about 2.7 million vehicles in North America in 2019, of which about 1.2 million are SUVs, accounting for more than 40% of sales. Including minivans (about 400,000 vehicles), that figure will rise to 60%.

In 2007, before the subprime crisis, Toyota sold about 2.7 million vehicles in North America, including about 600,000 SUVs, which accounted for half of the total sales in 2019. With the gradual expansion of THE SUV market in North America, the sales of Toyota's RAV4 and Highlander and other models have achieved steady growth. In 2017-2018, the sales of Toyota's SUV in North America surpassed those of Camry, Corolla and other cars.

In the first half of the year, Toyota's sales of new cars in The United States fell nearly 50% from a year earlier in April, but fell to about 30% in The April-June period and only 19% in the year to July.

"China is the Most Important"

Mr. Toyoda made two points during the earnings call

First, the company has room to reduce costs;

Second, the performance contribution of the Chinese market was highly recognized.

As mentioned above, Toyota has been inclined to reduce its cost in recent years due to the huge money-burning pit of the new modernization transformation. However, in the view of Akio Toyoda and other executives, the impact of COVID-19 is an opportunity for Toyota to re-examine every detail of its operation and management, and the company will try its best to launch a series of improvement programs to reduce costs with the more efficient TNGA architecture as the main focus.

If the new-car market recovers gradually in the second half of the year and the above measures play their proper role, the cost reduction of Toyota in the March 2021 fiscal year is likely to increase to 200 billion yen to 350 billion yen.

Toyota in the subprime mortgage crisis period of the loss of 461 billion yen (about 30 billion yuan), in the east Japan earthquake in March, 2011 issue of the profit of 468.2 billion yen (about 30.4 billion yuan), due to the reflection of two crises and structural reforms, COVID - 19 under the impact of Toyota will than in the past two troughs more cost competitive.

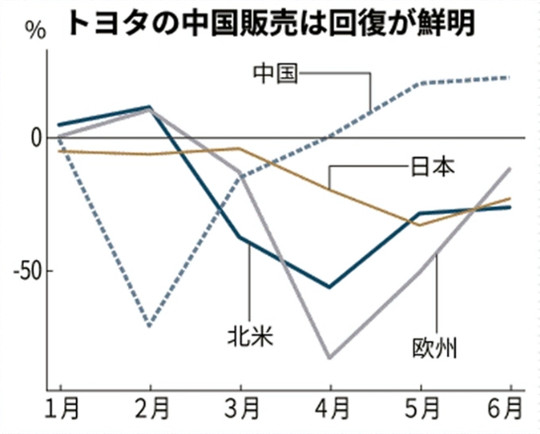

It is worth mentioning that The Chinese market, which was the first to emerge from the epidemic, contributed 482,000 vehicles to Toyota's cumulative sales in the april-June period, up 14.3 percent from 422,000 vehicles in the same period in 2019. Operating profit in Toyota's China business rose 20.2 billion yen (1.33 billion yuan) from a year earlier, helped by sales that bucked the trend.

Toyota has been affected by COVID-19 in China since the end of January, with sales in February down nearly 70 percent from a year earlier and in March down nearly 20 percent, but it started to show a slight increase in April and achieved about 20 percent year-on-year growth after May. Toyota's sales in China rose 1 percent from a year earlier in the january-July period as the new-car market recovered and new products rolled out.

The strong sales volume has driven the growth of revenue and profit.

Toyota reaped a total profit of 41.2 billion yen (2.67 billion yuan) from its Chinese joint ventures in the april-June period, up 30 percent from a year earlier. In addition, operating profit from Toyota's Joint ventures in China reached 55.8 billion yen (3.6 billion yuan), up 57 percent from a year earlier, both contributing significantly to Toyota's global earnings.

Taking into account the rebound in the Chinese car market and the pace of Toyota's product launches in the second half of the year, Toyoda set a sales target of 1.76 million vehicles in China by 2020, up 8.6 percent from the same period last year, maintaining the sales target set before the COVID-19 outbreak.

In the past year, Toyota bucked the trend despite an 8% decline in overall sales in China, selling 1.62 million vehicles (a 9% increase over the same period last year). For the first time, Toyota sold more vehicles in Japan (1.61 million), accounting for about 17% of the company's global sales, second only to the United States.

Compared with its competitors, Toyota is not only the largest automaker in Japan, but also the world's "most profitable auto company" in terms of sales and profits. Only Toyota has seen a significant sideways profit following the coVID-19 black Swan onslaught.

But if we're going to quibble over Toyota's first-half results and dig deep into the hidden tools and financial tricks to squeeze out profits, the most profitable automaker is still going red and black under huge pressure to show results. Only under the pressure, chief executive, akio toyoda, repeatedly stressed the "China's most important" (China が important だ), has become the biggest reality profit contribution in practice.

The essence of red and black, merit and fault is still taking and giving up under the management philosophy. Toyota has become the model of the industry in the second revolution of the industry, so in the current overall transformation of the auto industry, how to learn from Toyota and avoid warning, this powerful neighbor has become the best reference for Chinese auto companies.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!