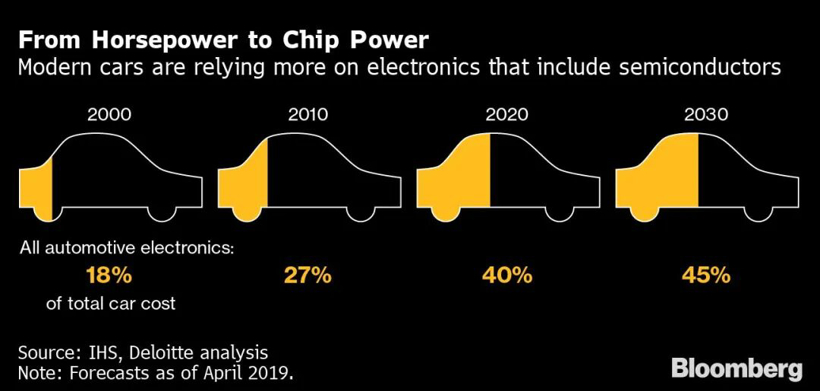

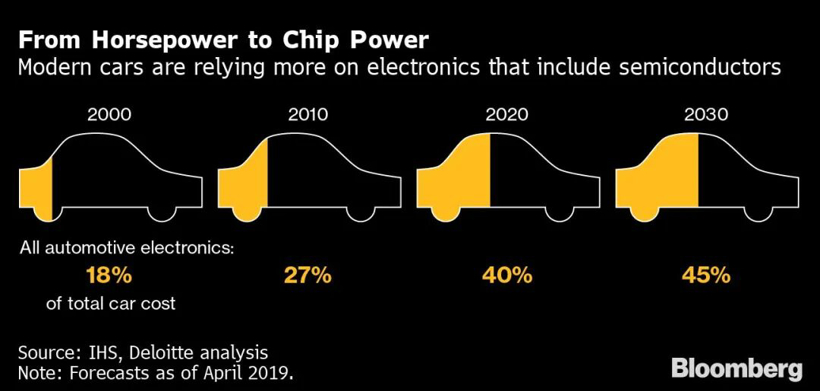

With the rapid development of artificial intelligence technology, the demand of global data centers for high-performance memory chips is explosive. Now, however, this trend is leading to a supply chain crisis affecting the automotive industry. Recently, a number of analysis institutions such as WellsUBS, UBS and S&P Global have issued warnings in succession that automakers may face serious cost pressure and production interruption risks as early as 2026 due to the continuous shortage of DRAM chips.g. The root of this crisis is that chip manufacturers are prioritising capacity to more profitable, faster growing data centers and AI markets, while the automotive industry has less than 10% share of the global DRAM market and weak bargaining power.

DRAM prices have risen tremendously so far. Wells Fargo reports that spot DDR5 prices are more than eight times higher than the 2024 average and DDR4 prices are more than 16 times higher. Although DRAM costs are currently only around $50 to $110 per vehicle, the dual pressure of price inflation and supply shortfalls could significantly squeeze automakers' margins, particularly for electric vehicles and premium models that rely on a large number of chips. Analysts forecast that global DRAM demand will increase by about 26% in 2026, while supply will only increase by about 21%, implying a supply gap of about 14%. At the same time, major chip suppliers, including Meridian, Samsung, and SK Hylitmus, are accelerating the shift to high-end products such as high bandwidth memory (HBM), further reducing the automotive industry's chip sources.

Although similar to the chip shortage in 2021, this crisis is driven by a more focused infrastructure that is reshaping the global semiconductor supply chain landscape. Automakers not only have to deal with price surges, but may also face line shutdowns due to chip outages.

AI Demand Squeeze Auto Industry

In fact, as early as December last year, Meng Qingpeng, Vice President of Ideal Automotive Supply Chain, admitted that "by 2026, the automotive industry will face an unprecedented supply crisis of storage chips, and the satisfaction rate may be less than 50%". Subsequently, NIO founder Li Bin stated in early January this year that the current increase in memory prices is a huge pressure on the automotive industry. In a live broadcast in January, Lei Jun, Chairman of Xiaomi Auto, also mentioned the price of the new Xiaomi SU7, saying, "The price of memory is rising quarterly now. Last quarter, it increased by 40% to 50%, and it is said that it will continue to rise in the first quarter. According to this trend, the memory of cars alone will increase by several thousand yuan this year." In fact, the core contradiction of the current tight DRAM supply chain stems from the resource competition between the explosive growth of demand for artificial intelligence data centers and the steady increase in demand for chips in the automotive industry. With the popularity of generative AI applications such as ChatGPT, Google Meta、 Amazon and other tech giants have seen a surge in demand for high bandwidth memory (HBM) and high-end DRAM, with profit margins for these chips far exceeding those of traditional DRAM products used in the automotive industry.

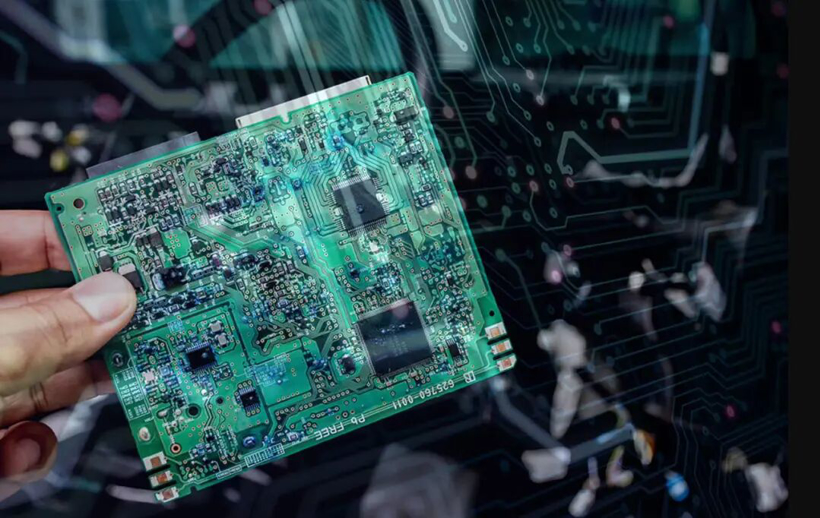

As a result, Samsung, SK Hellos and Maghave significantly shifted capital expenditure and capacity to the data center, and even gradually eliminated the old process chips such as DDR4, which are still widely used by automakers. S&P Global notes that this capacity shift is not a temporary adjustment, but a structural shift, as the profitability and growth prospects of AI data centers far outweigh the automotive market. The automotive industry is double disadvantaged in this competition. First, the market share is small, only accounting for less than 10% of global DRAM demand, and it is difficult to compete with the technology companies who frequently order hundreds of thousands of wafers in the procurement negotiation. Second, technology lags behind. Due to long certification period and high reliability requirements, the automobile often adopts chip manufacturing process that lags behind 1-2 generations of consumer electronics. Today, automakers are forced into the grip of reduced supply of old chips and insufficient capacity of new chips as chip manufacturers accelerate the elimination of old production lines in pursuit of higher profits.g. Wellsestimated that by 2025, the top ten Tier 1 auto suppliers will consume about 54% of the world's auto DRAMs, with BYD, Tesla andthe frontrunners, meaning that the supply chain risks of head companies are more concentrated. Furthermore, the urgency of the crisis is further confirmed by the data on the supply gap, which is forecast by Wellsthat DRAM demand will increase by 26% in 2026, while supply will only increase by 21%; UBS notes that the price of some automotive chips has risen by more than 100%.

More importantly, capacity expansion takes time. IBK Securities said that the supply tensions could not be eased before the new Samsung and SK Halplants could reach volume production by 2028. In addition, the shortage of memory chips is spreading from consumer electronics to the automotive sector as all industries share the same silicon wafer base capacity. S&P Global warns that the time window for automakers to redesign systems and lock supply is narrowing, and production interruption may occur between 2026 and 2028 if not adjusted in time. This shortage is also a key difference from the chip crisis in 2021, which was caused by the supply chain interruption caused by the epidemic, the prepositioning of consumer electronics demand and the rebounding of automobile demand.g. While this crisis is more focused on memory chips, the drivers are single and clear, and AI investment booms. This means that the solution is no longer just waiting for capacity to recover, but rather the automotive industry needs to reassess its chip strategy, including technology upgrades, supply chain restructuring and even deep collaboration with chip manufacturers.

How should automakers deal with

It is not hard to see how this round of memory chip shortages will have a diverse impact on the automotive industry. The first is cost pressure. At present, DRAM cost of each vehicle is less than USD 200, but Standard&P Global estimates that the new contract price may rise by 70% to 100% year on year in 2026. For high-end models equipped with more autopilot and entertainment systems, the chip cost of a single vehicle may be as high as USD 2000.

It is difficult for consumers to bear all the new costs, especially in the era of fierce price competition for electric vehicles, and the profit of manufacturers will be significantly squeezed. Wellsnotes that there are already signs of panic procurement, which could push prices up and disrupt production plans, creating a vicious cycle. There is also a risk of production disruptions, with UBS warning that shortages could disrupt global auto production as early as the second quarter of the year. The most affected will be electric vehicle manufacturers highly dependent on advanced chips, such as Tesla, Rivion and BYD, because these enterprise models are more digital and require more memory.g. Traditional auto enterprises such as Ford and GM are relatively less affected, but high-end models are also facing challenges. It is also difficult for first-tier suppliers in the upstream supply chain to be unique. Enterprises such as Visteon and Amb, which mainly provide high-tech cockpit and driver assistance systems, will directly lead to order delivery delay due to chip shortage. If chip supply continues to be tight, the likelihood of some models being discontinued between 2026 and 2027 is not alarming. To deal with the crisis, the automotive industry can seek ways out from both short-term relief and long-term transformation. Short-term strategies include locking supply, adjusting configuration and cost pass-through. It is reported that some auto enterprises have tried to sign long term agreements with chip manufacturers, but the results are limited, because the capacity priority still tends to the data center. At the distributor level, it is possible to relieve stress by simplifying configurations and extending delivery times.

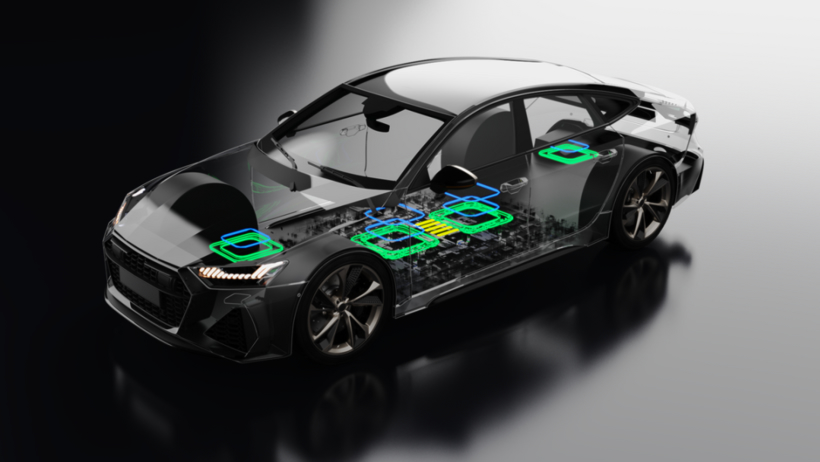

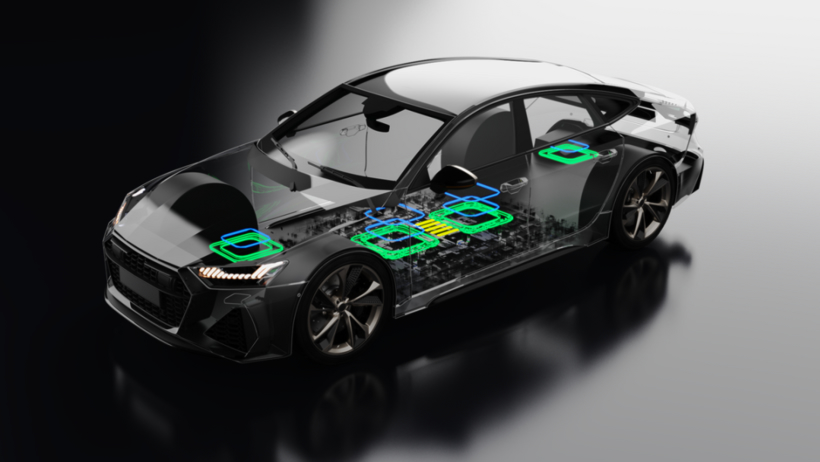

In the long term, the automotive industry must accelerate technology iteration and supply chain independence. For example, Tesla has independently developed AI chips and keeps close cooperation with Nvidia; BYD also arranges chip production, although the current product is relatively basic. More automakers may be forced to redesign electronic architectures, reduce reliance on a single chip, or move to processes such as more advanced DDR5, but this will take time and cost a lot.g. It can be said that this crisis reveals the deep vulnerability of the automotive supply chain. With the advent of the software-defined automotive era, chips have evolved from common parts to strategic resources. In the future, automakers may need to be more deeply involved in chip design, invest in chip capacity, or establish equity cooperation with suppliers. S&P Global recommends that the automotive industry establish a more flexible supply system while driving standardization of chips to reduce dependency on specific models. For consumers, buying in the next few years is likely to see fewer options, longer waiting times and even higher prices, especially for high-technology models. In short, the shortage of memory chips triggered by AI is pushing the automotive industry into a new supply chain storm. This crisis is not only about costs and production, but also forced the industry to rethink its position in the global semiconductor ecosystem. Enterprises that can quickly adapt to and actively deploy their chip strategies may gain a greater competitive advantage in the wake of a crisis, while those who are slow to react may face the risk of being out-minded.g. In this era of chip and core competitiveness, the transformation road of automobile manufacturing industry is destined to be full of challenges.

English

English Chinese

Chinese