Scan QRCode

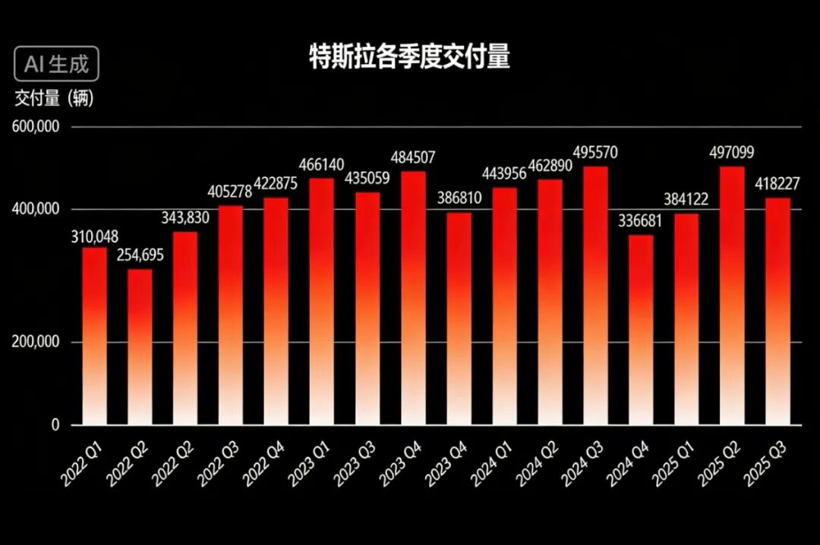

In 2025, Tesla's performance in car manufacturing alone is undoubtedly disappointing. Units, 384000 units, 497000 units and 418000 units are the specific global delivery results of the corresponding four quarters. Having gone through the downturn in the first quarter, the second quarter began to pick up, and after the third quarter hit the high point, the fourth quarter went down unexpectedly.

Finally, with 1.636 million units, the American new energy vehicle enterprise brought an awkward end to the past 365 days. Compared with 1.789 million in 2024, the year-on-year drop is more than 8%. It will be further away from 1.808 million vehicles in 2023. The "negative growth" for two consecutive years has completely alarmed the American new energy vehicle enterprise. At this moment, 2026 has already started. The urgent task for Tesla is to boost orders as soon as possible, especially in the main sectors, such as the Chinese market. In 2025, according to the statistics of China Railway Vehicles Federation, its retail sales in China will be 625000 units, down 4.78% year-on-year. Including post-export wholesale sales of 851000 units, 7.08% y-o-y. Overall, not optimistic. However, there is also good news that the pricing system is basically maintained, and there is no large-scale back pricking official drop. More financial policies are used to continuously stimulate and pry terminal potential customers. In 2026, Tesla will continue to increase the code at the right time, and at the same time, for the six-seater version of Model Y L, the "five-year interest free" scheme is launched; On the other hand, for the rear wheel drive version of Model 3 and Model Y, the long-endurance rear wheel drive version, the long-endurance all-wheel drive version, and the six-seater model Y L, the "seven-year ultra-low interest" scheme was launched for the first time.

The latter, in particular, triggered a lively discussion. Taking the rear wheel drive version of Model 3 as an example, the current official website price is 235500 yuan. Without any optional configuration, the down payment is 79900 yuan, the loan is 155600 yuan, and the monthly supply is 1918 yuan. There are 84 phases in total, the annualized rate is 0.5%, the annualized rate is 0.98%, the annual principal interest is only about 800 yuan, and the total interest in 7 years is only 5000 yuan. Undoubtedly, Tesla's "seven-year ultra-low interest rate" scheme once again greatly reduces the so-called threshold for car purchase, which is very suitable for consumers with tight preliminary budget, low monthly supply and long-term ownership plan. Or, those with money for better financial purposes, after all, have an annualized rate of 0.98%, much lower than the 4% - 8% rate set by the prevailing market for car loans. The down payment is less than 80000 yuan. I bought a Model 3 for about seven years. The monthly repayment is less than 2000 yuan, so it is considered as a car rental. I don't want to drive after seven years, and then drive the car. It is estimated that the residual value can be about 50000 yuan. To be honest, it is quite worthwhile. It is very suitable for me, a Buddhist worker who basically will not change too much. ”By no means a hype, in the first time Tesla launched the "7 years of ultra-low interest" program, the people around quickly sent messages, from his words, can feel a high interest.

To cover it with a point, this wave of financial policy in China is undoubtedly showing its due effect. Further on, on the eve of the Spring Festival, in the so-called slack season, the American new energy vehicle company has put the purpose on the table - on the premise of not destroying the pricing system as much as possible, with good faith for a good start in China in 2026. Slightly, as the largest competitor of Tesla, Xiaomi Automobile quickly followed up with the huge pressure in 2025. In the recent live broadcast, Lei Jun announced on the platform in person that, in response to users' expectations for flexible car purchase, he officially launched the "seven-year ultra-low interest rate" scheme for YU7 from 00:00 on January 16, which is applicable to users who have completed the order before February 28, 2026 (including February 28, 2026). In accordance with the new policy, consumers can enjoy the minimum down payment of 49900 yuan when buying YU7, the monthly supply is as low as 2593 yuan, and the loan term can be up to 7 years. Undeniably, Mille's "operation" clearly refers to Tesla. In the live broadcast, Lei Jun said blatantly, "Many rice noodles left a message to hope that we can provide similar support, and we carefully listened to everyone's voice."

In my eyes, such fast follow-up, on the one hand, shows the strong executive force and efficiency of the new Chinese car; On the other hand, it reflects that the current terminal competition is still intensifying, and Xiaomi also has considerable anxiety at the level of new orders. In essence, the "seven-year ultra-low interest rate" scheme can be fully understood as a covert price war initiated by the main engine plant by cutting meat for profit. It can be foreseen that there will be more and more brand follow-ups. That said, just this week, the ideal choice for 2026, when sales were under pressure, entered the picture. Seen from the official release of the poster, "Starting from the down payment of 32500 yuan, the monthly supply is as low as 2578 yuan, and the new car can easily drive home." For MEGA and i8, there are exclusive 7-year loan programs, which can enjoy the first three years of interest free, and the monthly supply is as low as 2857 yuan. In addition, according to the news from more netizens, earlier, Dongfeng Yipai all models followed up the "seven-year low interest" program. It is in this context that one cannot recall the interesting ideas learned from previous discussions with an industry insider. From his point of view, I have always felt that in the era of motorization in which game rules and overall pattern are completely renovated and reshaped, and financial policy play methods of major auto enterprises should be more bold and richer.

The "seven-year ultra-low interest rate" is nothing, and the "ten-year ultra-low interest zero down payment" is interesting. Even the real on-demand subscription service should be launched, completely breaking the traditional car purchase mode. It not only reduces the selection barrier, but also increases the user stickiness and ensures the profit return. Perhaps, in the eyes of some questioning people, such a way is a little radical. However, I think that there is huge innovation space and flexibility in the sales link when the Chinese car market is so large. Of course, past experience has taught us that everything beneficial is always harmful. With respect to 2026, many new energy brands have followed Tesla's "seven-year ultra-low interest" program, seeing another analysis that "most people only see the reduction of monthly supply pressure, but ignore the uncertainty brought by the extension of time." In other words, according to the current iteration speed of smart electric vehicles, the technical dimension will definitely change dramatically after seven years, and the popularization of solid-state batteries and the landing of automatic driving are not impossible. You're paying off a loan for an "old car.".

In contrast, depreciation is the more awkward issue. Once the whole industry really enters the next stage of the technology explosion, the "old car" residual value will decline more quickly. Perhaps, after just three or four years, the market price has been below the balance of the loan. By no means alarmist, "it is necessary to be very careful to lock a current product with long-term liabilities in this era of crazy internal volume." As for spending a certain amount of time to explain the above contents, it is not to say down the "seven-year ultra-low interest rate" scheme. But we want to let everyone remember that any financial promotion will have its "positive and negative". Don't just think that the order is placed blindly at the moment, and ignore the uncertainty caused by time extension. For many things, it is not too late to make a decision by considering the consequences and costs. In short, it's the same saying: "Think about yourself and do what you can."

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!