Scan QRCode

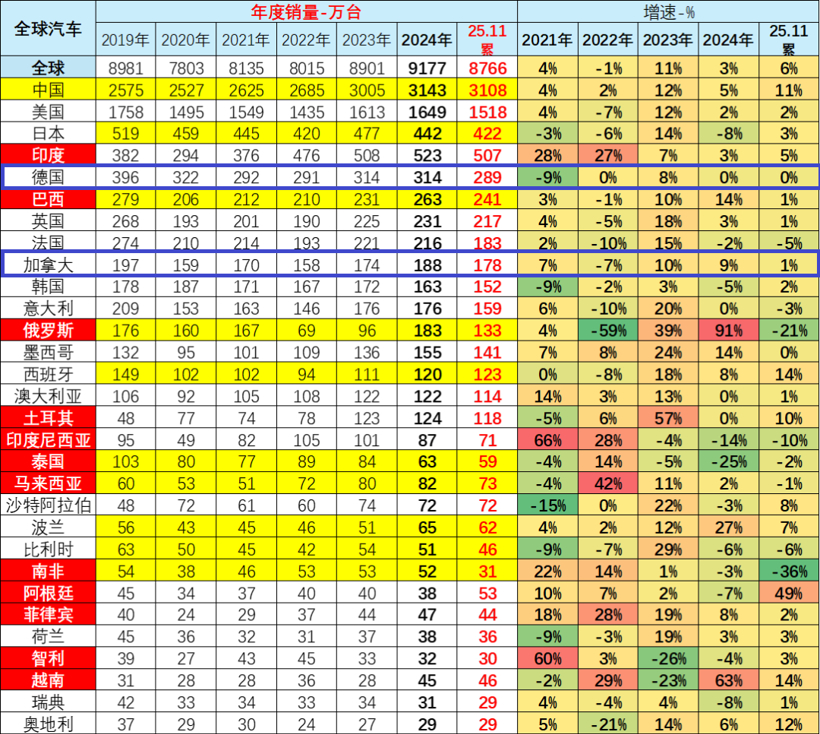

In recent years, China's auto exports have been frequently reported with good news. Data from China Association of Automobile Manufacturers shows that automobile export will reach 7098000 units in 2025, with a year-on-year growth of 21.1%. However, the data of the General Administration of Customs is higher, including vehicles and complete sets of spare parts. The annual export volume is 8.32 million units, a year-on-year increase of 30%, and the export volume is USD 14.24 billion. On one side there are fast growing numbers and on the other side there are a series of good policies for the overseas market. On January 20, it was reported that the German government, in order to boost electric vehicle sales, planned to launch a 3 billion euro subsidy, which was open to all manufacturers, including Chinese brands.

The new subsidy scheme is expected to last until 2029 and is expected to support the purchase of around 800000 EVs. The amount of subsidy varies from 1500 to 6000 euros depending on the vehicle type and the income level of the buyer, with a focus on low - and middle-income groups. Industry analysis believes that Germany's move will bring significant benefits to China's auto exports to Germany. In 2025, the sales volume of Chinese auto enterprises in the passenger vehicle market in Germany will be 68700, with a year-on-year growth of 120.4%. Despite all the unfavorable conditions, Chinese automakers have created new sales records in the German market. However, according to the prediction of the organization, Chinese auto enterprises are expected to reach 100000 units in the German market in 2026. Recently, Canada announced that China's EV tariff would be reduced from 106.1% (6.1% most-favored-nation tariff+100% additional tariff) to 6.1%, with an import quota of 49000 units for the first year, increasing to about 70000 units per year by the fifth year, and more than 50% of imports would be "affordable EVs with prices below $35000", creating new low-cost options for consumers in Canada.

In addition, Canada also said that it plans to build local electric vehicles in Canada based on Chinese technologies through joint venture cooperation and investment with Chinese enterprises in the next three years, aiming to be the first country in North America to realize this vision. Under the background of severe internal volume, weak growth and soaring overseas export, the growth potential and future of Chinese automobiles must be in the vast overseas market. For several days, the relatively loose trade barriers in the markets of 2 million units in Canada and 3 million units in Germany have indeed brought more opportunities and possibilities for Chinese automobiles to the sea.

Canada, Germany not found conscience

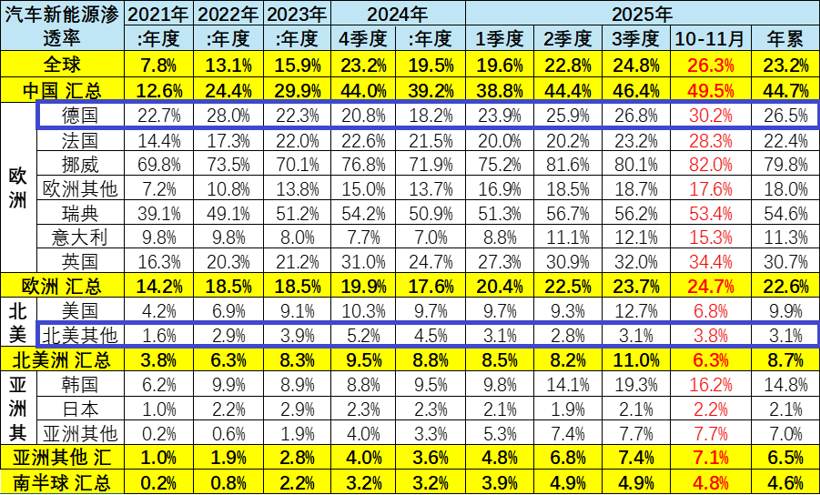

The world will not say good-bye to you for no reason, and there are always some purposes behind it, especially in the trade between countries. Obviously, Canada's release of automobile trade barriers to China is not an occasional policy looseness, but a result of its actual reversal in industry, market and diplomacy. First of all, the gap of local industry leads to relatively slow pace of green transformation. Although there are five automobile enterprises in Canada, including GM, Honda and Toyota, the new energy field is almost "half blank". The data shows that there is no electric vehicle factory with an annual capacity of over 50000 electric vehicles in Canada, the self-sufficiency rate of core parts is less than 8%, and key parts such as batteries and motors are highly dependent on imports. However, Canada has set the goals of 20% of new energy sales (about 380000 units) in 2026 and banning the sale of fuel vehicles in 2035. However, in 2025, the sales of pure electric vehicles in the country only account for 6% of the total sales of new vehicles, and the mix models account for 4%, and the market share is monopolized by American, Japanese and Korean automobile enterprises. The Ontario Financial Accountability Bureau report forecasts that, in the absence of external supply, 3400 jobs in the automobile manufacturing industry and 16300 parts jobs will be reduced in 2026, increasing the risk of industrial hollowing.

However, after the 100% tariff is levied in October 2024, the Canadian electric vehicle market is completely immersed in the "high price less choices". In 2025, the average selling price of new electric vehicles in Canada will reach CAD 63000 (about CNY 310000), while the threshold price of electric vehicles in China before tax is only CAD 26000 (about CNY 138000). This directly led to a 40% y-o-y crash in new registrations of zero emission vehicles in Canada in Q3 2025, with net tram sales cutting back. More importantly, the Canadian automobile industry has long been dependent on the United States, with 95 percent of Canadian automobile exports relying on the U.S. market. But Trump's huge tariff took a fatal blow to the Canadian automobile industry. In April 2025, Trump's government imposed a 25% tariff on Canadian automobiles and parts, which directly led GM to close a factory in Osand reduce the capacity of Ingersoll's factory. Stellantis canceled Jeep production plan at a plant near Toronto, and 750 workers were exposed to unemployment risks.g. Some analysts pointed out that the threat of American tariff led Honda and GM to consider relocating factories, which may cause Canada to lose more than 30 billion dollars in automobile export per year. Combined with recent examples of Trump's operations in Venezuela, his plans to "acquire land" in Greenland, and his painting of the American flag on Canadian lands, this has caused more concern in Canada. Under multiple pressures, the Canadian automobile industry either continues to be dependent on the United States, bearing the continuous impact of policy fluctuations; Or take the initiative to find new cooperation anchors in the global market.

The shift to cooperation with China, in essence, can be seen as a passive counterattack to U.S. trade protectionism. How about Germany? Although it is generally interpreted as "showing favour to China" by the outside world, in-depth study of the logic behind it will find that it basically points to the inevitable choice of Germany under the multiple pressures of industrial predicament, climate objectives and geogames. On the one hand, the market is in a downturn immediately after Germany terminates subsidies for electric vehicles at the end of 2023: the registration volume of pure electric vehicles slumped by 27% in 2024. Growth is increasingly weak, with the core reason being that electric cars are too expensive without subsidies. Data shows that low - and middle-income families in Germany account for 50% of the new car buyers, while most of the electric vehicle models of the local auto enterprises are more than 30000 euros. Volkswagen ID. 3 starts to sell 35000 euros, and Mercedes-Benz EQA is more than 40000 euros, which is out of line with the demands of low - and middle-income groups. What we need is electric vehicles that can be bought by ordinary families, not luxury products that only serve high-income groups, "said the president of the Association of Automotive Importers of Germany, setting out the core appeal of policy opening. The cost advantage of Chinese auto enterprises can make the sales price of subsidized models reach 20000 euros, directly activating the sinking market, which is the key to achieve the goal of "1 million electric vehicle registrations in 2026" in Germany.

Volkswagen Group closed the Dresden factory at the end of 2025, which is the first time in its 88 years of history to close the vehicle factory in the local, exposing the contradiction between high cost and low capacity; Although BMW and Mercedes-Benz speed up electrification, their software capabilities and battery technologies still lag behind Chinese auto enterprises. The analysis by the German Institute of Economics shows that German automakers' profit continues to fall due to declining market share in China, tariff shocks in the United States and unfavourable progress in electrification transformation, with up to 90000 jobs cut by 2030.g. The dilemmas at the industrial level and the pain of transformation also made Germany realize that it needed a catfish to compel German automobile innovation, and this catfish may be from China.g. The German environment minister said straightly: "There is no evidence that Chinese automakers will surge in and we choose to face competition rather than set limits." The German Association of the Automobile Industry predicted that subsidies will drive 17% increase in vehicle registrations in 2026, and the participation of Chinese brands will make this target easier to achieve. Of course, there is also a core element is the geographical game. Germany's electric vehicle subsidy to China gives a green light, which can also be seen as the exchange of cooperation with China with policy sincerity, providing a buffer for the trade friction between China and Europe in electric vehicles. After all, Germany's automobile industry business in China has been affected in the past two years, and new cooperation methods and communication strategies are urgently needed.

Who will enjoy the bonus first?For China, the favorable results of the two market policies are different due to different situations. First, look at Canada. The short-term dividend of 49000 vehicles quota is almost firmly locked by Tesla. After all, it is determined by the channel and capacity advantages already arranged. As early as 2023, Tesla has exported 44000 Model3/Y to Canada from its Shanghai plant, accounting for over 80% of China's total exports of electric vehicles to Canada in that year (China's exports of 41700 new energy passenger vehicles to Canada in 2023). At present, Tesla has 39 shops in Canada, covering major cities. Super charging network has been formed and after-sales service system is mature. In contrast, most Chinese self-owned brands have not yet entered the Canadian market, and huge costs and time are required to build channels from zero.

Reuters predicted that Tesla's Model 3/Y exported to Canada through its Shanghai plant in 2026 is expected to return to the 40000 units level in 2023, accounting for more than 80% of the 49000 units quota and becoming the biggest short-term winner. In addition, the Lianhua sports car already held by Geely clearly indicates that its pure electric supercar SUVelete has completed strict certification in North American market in 2024, becoming the only Chinese-made electric vehicle successfully entering the price range of over USD 80000 in North American market. The significant benefit of this tariff policy is expected to see Elesee a significant dip of around 50% in the planned sale price, a strong price advantage that is expected to drive an exponential increase in the number of Lotus lots sold in Canada. For Chinese self-owned brands, there is no competition for short-term quota in the Canadian market. However, for localized production and industrial chain output three years later, BYD, Geely, Chery and Stratare expected to become long-term players by virtue of their respective advantages. BYD should take the lead in supplying electric buses for Canadian transport agencies many years ago. These vehicles operate in the cold climate in Toronto and Vancouver, and their reliability has been verified. In July 2024, BYD also submitted documents to the Canadian government to consult on the entry of passenger vehicle market. This policy looseness coincides with BYD's ambitious overseas target plan in 2026, which may speed up the preparation for entering the Canadian market.

Geely is expected to become one of the first automakers with faster opportunities to enter the Canadian market through the collaboration of Volvo and Lotus. Since any vehicle manufacturer entering Canada must comply with strict safety and compliance standards, the vehicle must be certified to the Canadian Motor Vehicle Regulations, including collision testing, lighting requirements, and bilingual labels. Charging compatibility, cold weather performance and software positioning are also key considerations and GEELY already has the advantage of being faster than others in regulatory and entry verification. However, Chery, another big exporter, may have the opportunity of economical SUV. It is important to know that Canada's SUV market accounts for over 50%. Toyota RAV4 and Honda CR-V are always popular. In addition, Chery has sufficient experience in Russia, Brazil and other places. Whether in climate conditions or in actual combat, it has a strong accumulation. Of course, as the zero-run of new automobile enterprises, its new energy technology, sales volume and influence are increasing day by day, and the possibility of relying on Stratto enter the Canadian market cannot be ruled out. Return to Germany, the subsidy policy of electric vehicle is beneficial to whom, it depends on the specific performance of Chinese automobile in the German market at present. Based on the data in the first 11 months of this year, none of the top 10 brands in brand sales appear Chinese brands. However, BYD, MG and Zero Run rank top among Chinese brands in the German market. Among them, MG, as the earliest Chinese brand entering Europe, will sell 26000 units in Germany in 2025, with a market share of 1%; BYD will sell 23000 units in Germany in 2025, a YoY increase of 700%. Seals and YUAN PLUS make up over 80% of the sales volume. Zero running cars, 7280 units a year, an increase of 3989.9%, jumped from almost zero base to 0.3% share, and T03 and C11 models quickly gained consumer preference with high cost performance.

Thanks to the upgrade iteration of Polestar2 and 4, Geestar will sell 5007 units in Germany in 2025, with an increase of 57.4%; Xiaopeng has 2991 vehicles a year, up 661.1%. G9 and P7 series are emerging in the high-end electric SUV market. These brands are also expected to see a new round of growth under the subsidy. Some data also show that the penetration rate of Chinese-made electric vehicles in the German market has exceeded 11% in the third quarter of 2025, and this proportion is expected to rise further after the opening of subsidies. In fact, German subsidy policies imply a "encourage local investment" orientation. If Chinese automakers set up factories in Germany, they can enjoy additional tax credits (up to 5%). This provides opportunities for BYD, Chery and other enterprises to expand European capacity. To sum up, Canada and Germany open subsidies to China's electric vehicles, which is essentially a choice of "pragmatism over protector". It proves that, in the wave of global automotive electrification transformation, there is no permanent "local protection", only permanent "value competition". Although there are still many uncertainties in China's auto export in the future, the real significance of two successive trades is not the number of cars sold by the first one, but the fact that it tears up the mouth of trade protection, which proves that the technological and cost advantages will finally break the geographical barriers in the global auto industry reform.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!