Scan QRCode

Recently, a document circulating online titled "A Letter to FAW Toyota Dealer Partners" by FAW Toyota mentioned that production will be reduced until February next year to alleviate inventory and financial pressure on all dealer partners.

In response, Gaishi Motors confirmed the news to insiders close to FAW Toyota, who stated that this was a move taken in response to the current competitive environment in the market. On the one hand, we should face the practical pressure that distributors face in terms of funds, inventory, and revenue, and strive to ensure the quality of year-end sales. On the other hand, while stabilizing this year's sales and reasonable profits, we can also adjust our posture for the continued upward trend next year.

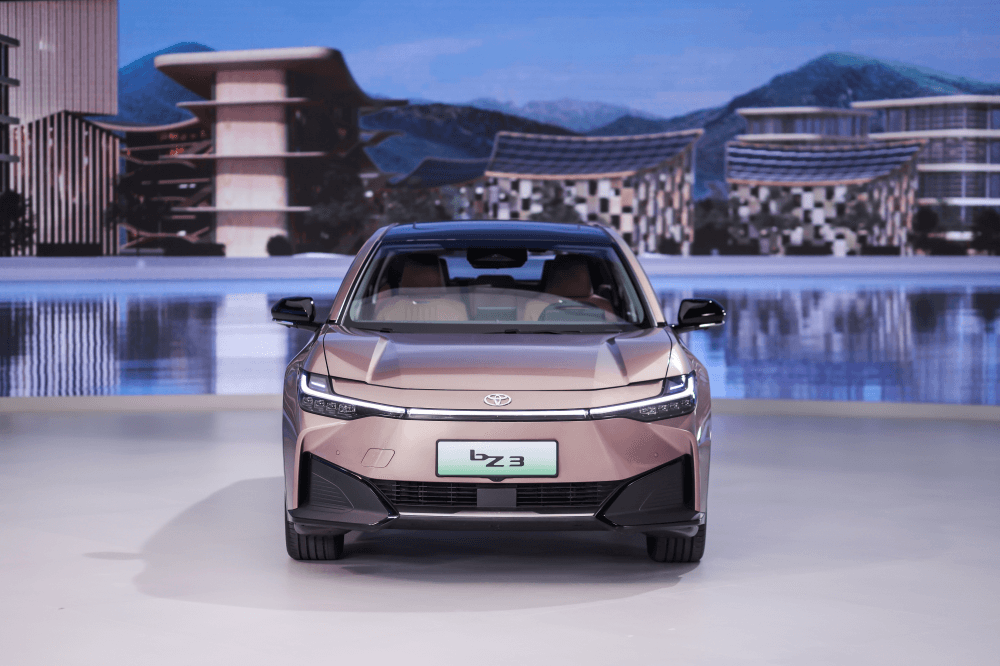

Image source: FAW Toyota

Continue to reduce production!

According to the content of the letter, this is not the first time that FAW Toyota has reduced production this year. In October and November of this year, FAW Toyota has significantly reduced production.

FAW Toyota stated that after intensive consultation and communication with all parties, the latest round of supply and demand adjustment plan has been officially formed, and it has been determined that production will continue to be significantly adjusted downwards from December this year to February next year. The specific reduction range is: the allocation will be adjusted downwards to 66000 units in December, 60000 units in January next year, and 38000 units in February.

FAW Toyota explained that the reduction in production capacity is to ensure the complete relief of inventory and financial pressure on all dealer partners, and to ensure the healthy and healthy business posture of all dealer partners. However, it also believes that "the next three months will still be the peak season for sales with the highest seasonal index throughout the year

Image source: FAW Toyota

It can be seen that in the overall decline in sales of fuel vehicles in the market, FAW Toyota has not been spared. Especially as the price war intensifies, both car companies and dealers facing the end market are under pressure. FAW Toyota's response strategy is to reduce production and work with dealers to overcome difficulties. So, FAW Toyota's production capacity will remain around 60000 vehicles in the next two months, and by the off-season of sales during the Spring Festival in February, the production capacity will be close to halving.

This also means that FAW Toyota will face overcapacity issues. According to the Gaishi Automotive Research Institute, FAW Toyota currently has 5 major production bases in the Chinese market (3 in Tianjin, 1 in Changchun, and 1 in Chengdu), with a standard annual production capacity of 1 million vehicles. In recent years, the capacity utilization rate has been around 70-80%. But after the production reduction, if the sales of gasoline vehicles do not improve significantly in the future, and new energy vehicles fail to fill the declining sales in a timely manner, the production capacity utilization rate of FAW Toyota is also worrying.

The epitome of the fuel vehicle market

Although FAW Toyota reduced production to alleviate inventory pressure on dealers, the fundamental reason is a slowdown in sales growth. According to data from the China Association of Automobile Manufacturers, FAW Toyota's retail sales in September were 78000 vehicles, a slight increase of 8.6% year-on-year; The cumulative sales volume from January to September was 664000 vehicles, a year-on-year increase of 0.8%, and the market share was 3.8%.

Although FAW Toyota reduced production to alleviate inventory pressure on dealers, the fundamental reason is a slowdown in sales growth. According to data from the China Association of Automobile Manufacturers, FAW Toyota's retail sales in September were 78000 vehicles, a slight increase of 8.6% year-on-year; The cumulative sales volume from January to September was 664000 vehicles, a year-on-year increase of 0.8%, and the market share was 3.8%.

Among the many joint venture brands, the market performance of the two major joint venture brands of Toyota (FAW Toyota and GAC Toyota) is relatively stable, at least maintaining a positive growth trend. Joint venture brands such as FAW Volkswagen, SAIC Volkswagen, Dongfeng Nissan, and SAIC General Motors are all facing a decline in sales. But compared to some Chinese brands, the market performance of FAW Toyota and GAC Toyota is also not impressive. For example, during the same period, BYD maintained a high growth rate of 62.8% and occupied a market share of 12.4%.

Image source: FAW Toyota

And the reduction in production by FAW Toyota is just a microcosm of the gasoline vehicle market. Affected by the new energy market, the entire market share of fuel vehicles has continued to decline, and it has now dropped to around 70%. This has led to a decrease in production capacity utilization for joint venture brands mainly focused on fuel vehicles. For fuel car dealers, the operational pressure has increased. If you encounter a car company that loves to keep inventory, dealers will face high inventory pressure.

Cui Dongshu, Secretary General of the Passenger Transport Association, recently stated that the contraction of fuel vehicles in the second half of the year was relatively severe, leading to a lack of substantial relief in inventory pressure. According to the dealer survey data released by the China Automobile Distribution Association, inventory pressure remains high, with an inventory warning index of 58.6% in October.

In such a situation, taking the initiative to bear operational pressure and improve dealer inventory pressure like FAW Toyota is a more humane choice. The above-mentioned insiders also stated that the absolute inventory of FAW Toyota is not high, maintaining around 1.1 (the reasonable inventory range for dealers is 0.8-1.5). However, due to the severe downward trend in market prices, FAW Toyota's sales end has tried to reduce the cost of dealer inventory funds and alleviate the pressure on dealer revenue.

At the same time, FAW Toyota is also preparing for change. Currently, the Chinese market has entered a new stage of large-scale development of new energy. Against this backdrop, Toyota is also accelerating its transformation towards electrification, and next year will usher in a period of intensive deployment of electrification.

Some industry insiders believe that after the active release of pressure by FAW Toyota this time, the entire channel can be easily launched, laying the groundwork for next year's comprehensive attack

This article is reprinted from Gaishi Automotive Information Network

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!