Scan QRCode

According to Clean Technica data, in April, sales of new energy vehicles in Europe reached 197950, a year-on-year increase of 25%, accounting for 21% of the entire European automotive market (with pure electric vehicles accounting for 13%). Among them, pure electric vehicles increased by 50% year-on-year, while plug-in hybrid vehicles decreased by 4% year-on-year.

The biggest highlight of April is that the Tesla Model Y still leads the entire European market. Let's take a closer look at who are the top 5 models?

The Tesla Model Y has become the best-selling electric vehicle in Europe for the sixth consecutive month, with sales reaching 10778 units. Its impressive performance in the first month of the second quarter is undoubtedly due to recent price reductions and the fact that the Model Y is one of the few electric vehicles with a balanced supply and demand ratio, which can be quickly delivered to anyone interested in purchasing. In terms of April's performance, the largest markets for Model Y in Europe include the UK (1550 vehicles), France (1333 vehicles), and Germany (1636 vehicles).

After August last year, Volkswagen ID. 4 once again jumped to the runner up spot with sales of 6682 vehicles. With the increase in production, ID.4 now has enough firepower to compete for second place in 2023, with its main market being Germany (2203 vehicles), followed by the UK (620 vehicles), Norway (602 vehicles), and Sweden (661 vehicles).

The Volvo XC40 (EV+PHEV) has sold 6004 vehicles, with the EV version being the main driving force for growth (4037 vehicles). The sales distribution of XC40 even covers several medium-sized markets such as Sweden (793 vehicles) and the Netherlands (699 vehicles). The UK is also the main country for sales (876 vehicles).

After experiencing a difficult year in 2022, Volkswagen ID.3 regained its rebirth in 2023 and even made it back into the top five with 5927 vehicles in April. Its main markets are Germany (2050 vehicles) and the UK (1115 vehicles), France (439 vehicles), and Norway (391 vehicles).

Despite not reaching the sales level of Volkswagen ID. 4, Skoda Enyaq's sales are still a surprise this month. With a sales volume of 5101 vehicles, the models under the MEB platform are currently in the recovery stage after a poor start to the year. Germany is its largest market with sales of 1405 vehicles, followed by 555 vehicles in the UK, 454 vehicles in Norway, 346 vehicles in Sweden, and 342 vehicles in Switzerland.

It is worth noting that the MG 4 ranks 7th. This hatchback proves that it is a force that cannot be ignored. In addition to MG, Chinese manufacturer Geely Group's Volvo XC40 and XC60 PHEVs, as well as Jixing 2 and Linke 01 PHEVs, all entered the list, ranking third, 12th, 17th, and 19th respectively.

Among the top 20 and below, several models have also shown positive performance, such as the recently launched BMW iX1 crossover car, which sold 2361 units. The sales of Mini Cooper under BMW Group are 2281 units. Kia's EV6 sales reached 2342 units, defeating Hyundai Ioniq 5 (2330 units) with an advantage of only 12 units.

Stellantis Group has achieved significant sales of three models, such as the Peugeot 2008 electric crossover (2058 units) and Opel pure electric vehicles, Corsa EV (2207 units), and Mokka EV (2116 units).

Throughout the entire European new energy vehicle market, compact and mid size vehicles are the dominant players, and Tesla Model Y continues to dominate mid size vehicles, even during off peak months.

The Model Y is closely followed by the Mercedes C-Class with sales of 7017 units and the Volvo XC60 with sales of 6259 units. Interestingly, 58% of Volvo's SUV sales come from its PHEV version, highlighting once again the rise of plug-in hybrids. The BMW 3 Series was once the ruler of mid size cars in Europe, but now it has not appeared on the leaderboard.

As for compact cars, the Volkswagen Group, especially its eponymous brand, is strengthening. Among the top five compact new energy vehicle rankings, there are four models under the Volkswagen brand (Volkswagen ID. 4, Volkswagen ID. 3, Skoda Enyaq, and Audi Q4). The best-selling models for small cars are the Fiat 500 and the Dacia Spring.

From January to April 2023, Tesla Model Y won the top spot in new energy vehicle sales in the European market with sales three times higher than the runner up Volvo XC40.

The second ranked Volvo XC40 successfully retained its silver medal, with the Volkswagen ID series surpassing the Tesla Model 3 in strong sales, with ID. 4 and ID. 3 rising to third and fourth respectively. One of the reasons is that Tesla Model 3's sales in Europe have decreased by 33% year-on-year this year, undoubtedly due to the black hole effect of its sibling model, Model Y. Europeans prefer station wagons or off-road vehicles/SUVs over sedans, and the Model Y is priced at 5000 euros more than the Model 3, which is not an easy sales achievement.

Other ranking changes include the rise of two other MEB platform models, the 11th Skoda Enyaq and the 18th Cupra Born, both rising by one position. The BMW i4 rose from 20th place in March to 19th place in April, surpassing the Hyundai Ioniq 5, while the Hyundai Kona EV rose to 16th place.

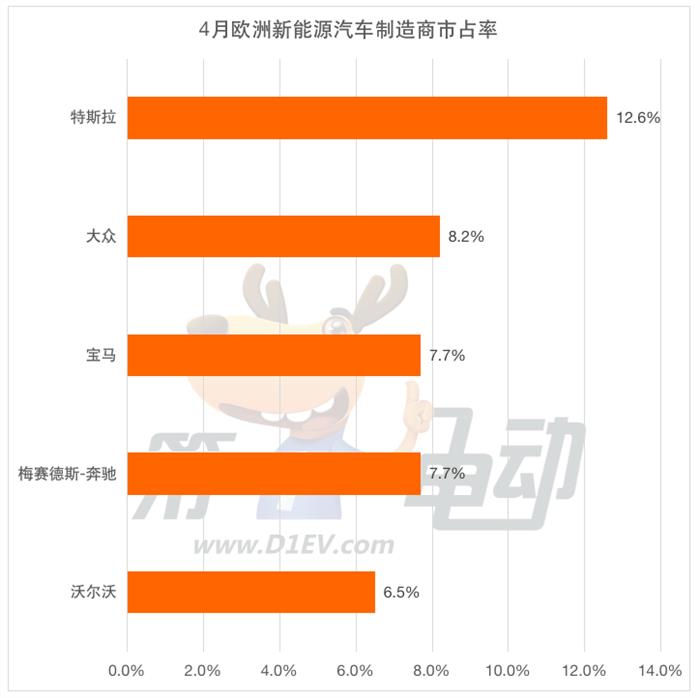

On the automaker rankings, Tesla leads with a distant 12.6% share, while Volkswagen ranks second with an 8.2% share, an increase of 0.3% from last month.

The position of third place has changed, with BMW (7.7%, up 0.3%) surpassing Mercedes (7.7%, up 0.1%). Volvo (6.5%) consistently ranks fifth, while Audi (5.4%) ranks sixth.

Comparing these results with the market share of a year ago, Tesla's leap is astonishing, with its share increasing by 5.7%. But the progress of the masses is also evident, with their share increasing by 2.1%. In addition, the biggest loser was BMW, which lost 1.8% of its market share, undoubtedly due to the overall impact of the decline in PHEV sales.

If viewed from the automotive group, Volkswagen Group's growth rate is as high as 19.6%, easily leading the new runner up Stellantis (13.9%), which surpasses Tesla (12.6%) during off peak hours. It is expected that this American manufacturer will soon return to its second place position.

BMW Group, ranked fourth, rose to 9.3%, while Geely Volvo, ranked fifth, rose to 9.2%. Despite Mercedes Group ranking sixth (8.6%, up 0.2%), Geely (9.1%, up 0.2%) can still maintain ease and is expected to surpass BMW Group ranking fourth next month.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!