Scan QRCode

Due to factors such as quarter end impulse, the installed volume of power batteries in China decreased in April.

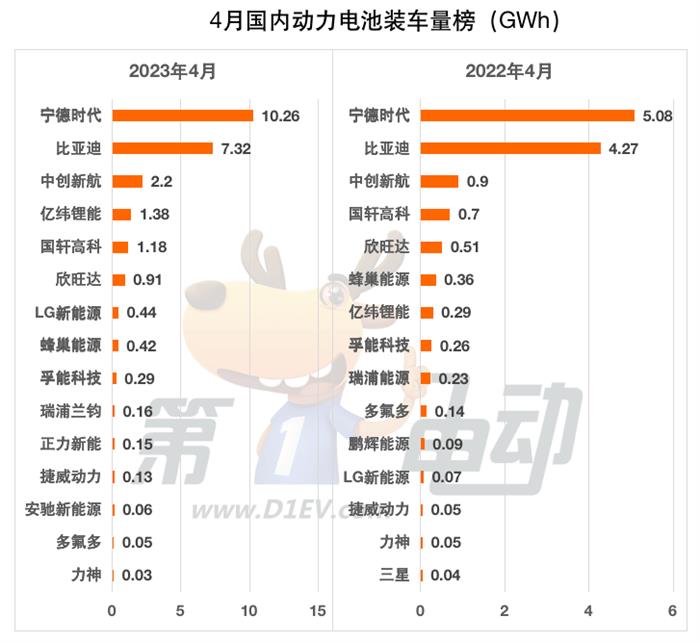

According to the latest data from the China Automotive Power Battery Industry Innovation Alliance, in April, China's power battery installation volume was 25.1GWh, a year-on-year increase of 89.4%, and a month on month decrease of 9.5%. Among them, the top 15 power battery enterprises accounted for 99.5% of the market share. From January to April, the cumulative installed capacity of power batteries in China was 91GWh, a year-on-year increase of 41%.

The loading volume of Ningde Times was 10.26 GWh, a decrease of 17.9% month on month, and the market share decreased by 4.1 percentage points month on month to 40.9%, still firmly ranking first. The Kirin battery has been mass-produced and installed in vehicles, and the recognition of the battery by car companies is crucial. In the future, condensed state batteries with a single energy density of up to 500Wh/kg will be another "killer weapon" of the Ningde era.

BYD's loading volume is gradually approaching the Ningde era, with a slight decrease of 1.1% month on month in April to reach 7.32GWh, and the market share has increased by 2.5 percentage points month on month to 29.2%. At present, BYD's sales are unbeatable, but its pure electric models only account for half, and the other half of its plug-in hybrid models use fewer batteries. At present, BYD's Jaguar Champions Edition, Seagull and other pure electric models are on the market. Once sales increase, it will help BYD's power battery market share reach another level.

The loading volume of China Innovation Airlines was 2.2GWh, a significant decrease of 23.1% month on month, and the market share also decreased by 1.5 percentage points month on month, ranking third on the list. It is understood that models such as the all-new NIO ES6, Xiaopeng G6, Deep Blue S7, Aian Hyper GT, and Smart Genie # 3 all use power batteries from China Innovation Airlines. It can be foreseen that with the successive launch of these models, the market share of China Innovation Airlines will reach a new high.

Compared to the top 15 power battery companies in March, the position of the top 11 power battery companies in April remained unchanged, and the ranking has changed since 12th. Yuanyuan Power, SK, and Tianjin New Energy have been replaced by Zhengli New Energy, Lishen, and Anchi New Energy. In March, ranked 15th in the rankings, Doflurane rose one place to 14th.

It is worth noting that for the first time, Mercedes Benz New Energy has made it to the 15th place on the list. Anchi mainly provides battery support for commercial vehicles such as trucks, buses, and sightseeing vehicles, and has reached strategic cooperation with Geely, Wuling New Energy, Dongfeng, China FAW, Chang'an New Energy, Jianghuai Automobile, etc. At the same time, it also provides battery support for passenger car models such as Chang'an and Junfeng.

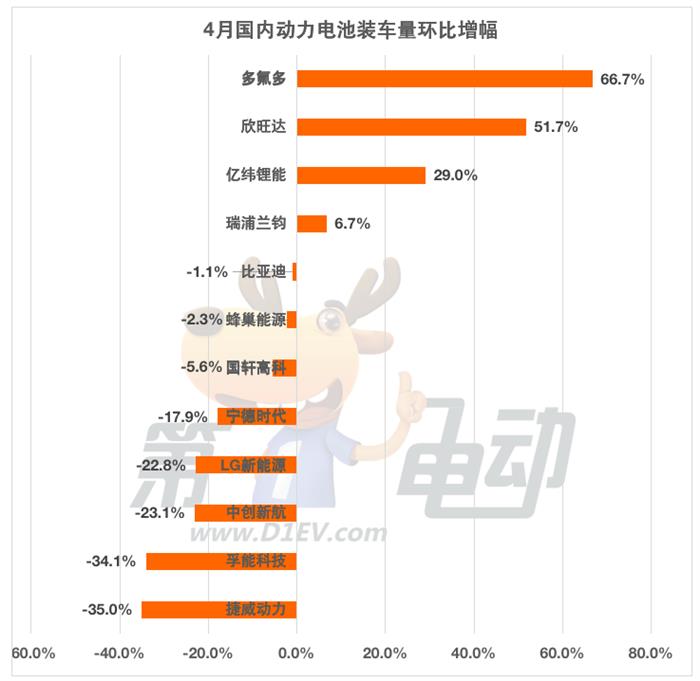

From a month on month growth perspective, the growth rates of Dofluoro, Xinwangda, and Yiwei Lithium Energy increased month on month, with Dofluoro experiencing the highest growth rate of 66.7%, followed by Xinwangda experiencing a month on month growth rate of over 51.7%. The reason why Xinwangda is highly favored by customers is closely related to its strong independent innovation ability and high-strength research and development. Last September, Xinwangda unveiled its first super fast charging power battery - SFC480- in Zaozhuang, Shandong, marking its official entry into the "super charging race" of power batteries. At this year's Shanghai Auto Show, Xinwangda released the "Flash Charging Battery", which is characterized by supporting electric vehicles with an easy range of 1000 kilometers and can be charged from 20% to 80% SOC in 10 minutes.

Eight companies, including Jiewei Power, Funeng Technology, China Innovation Airlines, and LG New Energy, experienced a month on month decline. Among them, Jiewei Power experienced a maximum decrease of 35% month on month, followed by Funeng Technology's decrease of 34% month on month, and China Innovation Airlines and LG New Energy's decrease of over 20% month on month.

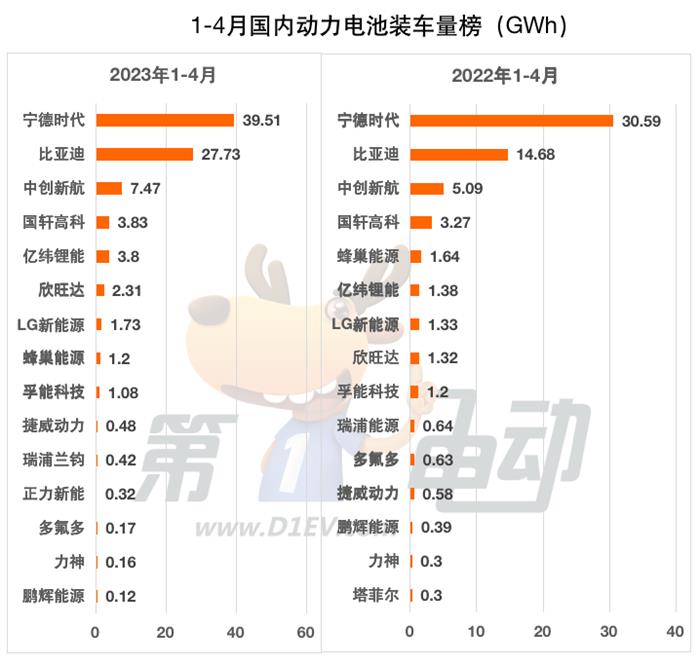

Compared to the same period last year, the ranking of the top four has not changed, with Ningde Times, BYD, and China Innovation Airlines firmly ranking in the top three, followed closely by Guoxuan High Tech. The former fifth place Xinwanda was replaced by Yiwei Lithium Energy, and the sixth place Honeycomb Energy was replaced by Xinwanda, dropping to ninth place. The 10th place Polyfluoro was replaced by the Jetway Power, which dropped to 14th place.

After the 10th place on the list, the rankings of all companies have changed, with Penghui Energy and Samsung dropping out, and Zhengli New Energy and Anchi New Energy replacing them on the list.

This also means that the top companies in the power battery market are relatively stable, with the overall market share of Ningde Times and BYD reaching as high as 70%, and the remaining 30% of the market share being won by the second tier companies.

In terms of battery types, in the field of ternary batteries, the installed capacity of ternary batteries in April was 8.0GWh, accounting for 31.8% of the total installed capacity, a year-on-year increase of 83.5% and a month on month decrease of 8.3%; The cumulative installed capacity of ternary batteries from January to April was 28.9GWh, accounting for 31.7% of the total installed capacity, with a cumulative year-on-year increase of 12.3%.

The field of ternary batteries is still dominated by the Ningde era, with a stable first place loading volume of 4.5GWh in April. Its market share increased by 10 percentage points year-on-year to 56.22%, followed closely by China Innovation Airlines and Xinwangda. Among them, China Innovation Airlines' market share increased by 2.1 percentage points, while Xinwangda decreased by 4.4 percentage points year-on-year.

Forth place Funeng Technology was replaced by LG New Energy, which benefited from Tesla's increased sales and jumped to 6th place, with a market share increase of 3.8 percentage points to 5.44%. Jaguar Power made the list, while BYD, which ranked ninth in the same period last year, fell off the list.

It is worth noting that thanks to the skyrocketing sales of the AION Y/S model under GAC Aian, Juwan Technology Research has made it to the 15th place on the list for the first time.

In April, the installed volume of lithium iron phosphate battery was 17.1GWh, accounting for 68.1% of the total installed volume, up 92.7% year on year and down 10.0% month on month. From January to April, the cumulative installed volume of lithium iron phosphate battery was 62GWh, accounting for 68.2% of the total installed volume, with a cumulative year-on-year growth of 60.2%.

The field of lithium iron phosphate battery still presents the pattern of "two heroes competing for hegemony" in the era of BYD and Ningde, with the market share of both up to 76%.

Compared to April last year, aside from BYD and Ningde Times firmly ranking first and second, the third place has changed, and Guoxuan High Tech has been replaced by Yiwei Lithium Energy, which ranked seventh in the same period last year. The fifth place honeycomb energy was replaced by China Innovation Airlines, while honeycomb energy fell to seventh place.

Penghui Energy, which ranked eighth in the same period last year, and Lishen, which ranked tenth, both fell to the top ten, with Zhengli New Energy and Anchi New Energy replacing them.

From January to April, compared to the same period last year, Ningde Times, BYD, China Innovation Airlines, and Guoxuan High Tech still remained in the top four. In addition, the ranking of other enterprises has basically changed, with Honeycomb Energy, which ranked fifth in the same period last year, being replaced by Yiwei Lithium Energy, Xinwangda ranking rising two places to sixth, and Funeng Technology ranking ninth and tenth, while Ruipu Lanjun was surpassed by Jiewei Power. Zhengli Xinneng's ranking increased by two places to 12th, while Penghui Energy's ranking decreased to 15th.

In terms of market share growth, BYD, Yiwei Lithium Energy, Xinwangda, and China Innovation Airlines achieved positive growth in market share year-on-year, with BYD experiencing a significant increase of 7.7 percentage points year-on-year. The market share of the other 11 enterprises has all experienced a year-on-year decline, with Ningde Times experiencing a maximum decrease of 4 percentage points, followed by Honeycomb Energy experiencing a decrease of 1.2 percentage points.

Overall, in the power battery market in the first four months of this year, the market share of Ningde Times (43.4%) and BYD (30.5%) reached 73.8%, an increase of 3.8 percentage points compared to the same period last year, and the "duopoly" pattern remains prominent. Less than 30% of the remaining market is being contested by numerous enterprises, and the competition in the second tier market is becoming increasingly fierce.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!