Scan QRCode

Finally, amidst the howls of sorrow, the Chinese automotive market saw its strongest performance in April.

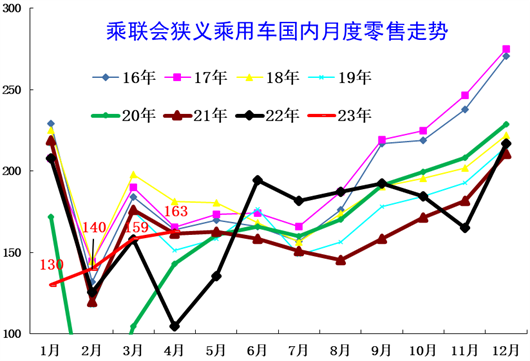

In April, the retail sales of passenger car market reached 1.63 million units, a year-on-year increase of 56%, achieving the strongest growth rate since the beginning of this century; The month on month growth of 2% is also one of the only two positive month on month growth since 2010.

In fact, since Tesla's price reduction at the beginning of this year, the Chinese automotive market has been in a long-term fierce competition. And this dispute reached a climax with the addition of BYD's championship model. When everyone thinks this is just a game of new energy vehicles, little does it know that the gasoline vehicle market has been more thoroughly affected.

Due to this impact, the first quarter, which was supposed to have started well, lacked quality. Naturally, the pressure was transmitted later, and fortunately, in April, all unstable factors such as "price war", holding currency for purchase, and weak consumption were alleviated. At the wholesale end, passenger car manufacturers nationwide wholesale 1.788 million vehicles in April, a year-on-year increase of 87.6%.

However, the biggest highlight of the April data is not the rebound in sales, but the clear trend of destocking. In April, manufacturers reduced production, but retail sales rebounded, driving improvement in channel inventory, resulting in a destocking trend where manufacturers' production was 30000 units lower than wholesale sales, while domestic wholesale sales were 140000 units lower than retail sales.

However, it is worth noting that although sales have stabilized, the promotional discounts at the end of the market in April are still rising. Actually, this is good news for the overall car market this year. When the participation of various industries and sectors in the car market tends to be harmonious, then there is no excuse for normalized competition.

Full bloom, just one family away

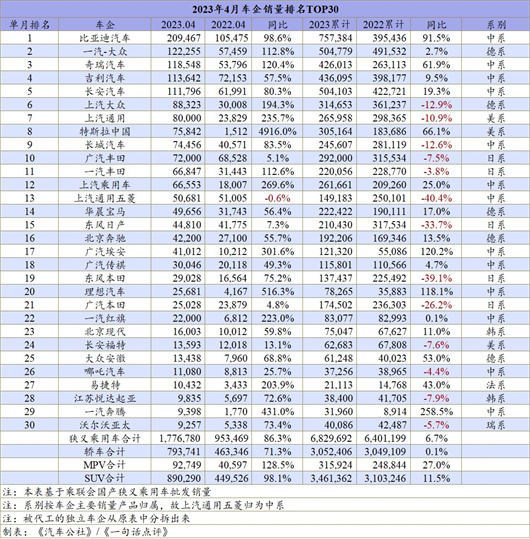

Thanks to the strong rebound in performance in April, major car companies have also shown a "hello, hello, everyone" situation. In April, among the top 30 car companies in terms of sales, only SAIC GM Wuling experienced a year-on-year decline, while all 29 other car companies achieved positive growth. Among them, there are 12 car companies with growth rates exceeding 100%.

Among the 12 car companies mentioned above, 8 are traditional car companies rather than new energy brands, namely "North South Volkswagen", Chery, SAIC General Motors, FAW Toyota, SAIC Passenger Cars, Red Flag, and Pentium. But it can be foreseen that their growth is also inseparable from the explosion of new energy vehicle products.

However, there are also car companies that are an exception, such as Chery Motors, which has repeatedly squeezed into the top three. Since last year, Chery Motors has been in acceleration mode, becoming a dark horse among its own brands. If last year's Chery still relied on the momentum of new energy vehicles, then this year's Chery's new energy vehicles have actually experienced a significant decline.

Why can Chery maintain such a growth rate while the new energy sector is declining? This is another key focus of Chery, which is the overseas market. Therefore, when debating who is the top seller overseas, Chery is also SAIC's biggest competitor. According to different calculation and statistical criteria, both can be referred to as the top exporter of independent brands.

Of course, including Chery, among the top 5 car companies in April, four domestic brand car companies have been shortlisted, leaving only FAW Volkswagen in self pity. These five car companies are also the ones among all car companies with monthly sales exceeding 100000 vehicles, and have experienced a more severe pattern of faults since the sixth place.

In fact, this also reflects another issue, apart from BYD, Chery, Geely, and Changan being able to rank at the top, they are relatively carefree. So for other independent brand car companies, including Great Wall, they have to walk on thin ice in the midst of a fierce competition with foreign brands.

Of course, some foreign brands are also trembling. The lowest growing companies among the top 30 are GAC Toyota at 5.1%, Dongfeng Nissan at 7.3%, and GAC Honda at 4.8%, with only these three companies showing single digit growth rates. And all three are Japanese car companies, and they happen to be three major manufacturers.

For joint venture brands, the only uncertainty in the Chinese market is the development of new energy vehicles, breaking the development model of foreign brands in traditional fuel vehicles that has existed for hundreds of years. Therefore, we have seen too many foreign brands rapidly decline in the Chinese market in recent years, and we have also seen new car brands like spring breeze.

Based on this, the two new energy companies with the best performance in April and January April are still the best. One is a foreign Tesla, and the other is an ideal car in China. Whether Tesla is reducing or increasing prices in the Chinese market, or the successful breakthrough of Ideal Automobile, it has proven that product strength is the core of the hard truth.

This has significant implications for participants in the Chinese automotive market, especially for all car companies this year. If they want to survive successfully, they cannot only be complacent about their achievements in April. The future price war will continue, and competition will become even more fierce.

Unexpectedly, the Japanese are the most injured

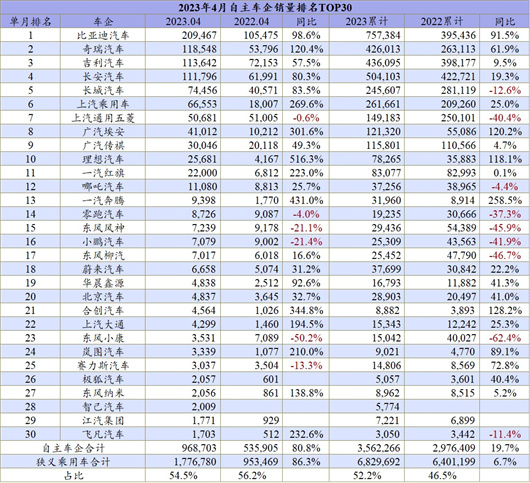

Therefore, self owned brands with more flexible operating mechanisms and faster turnaround speed are beginning to take root in people's hearts. In April, self owned brand retail sales reached 790000 units, a year-on-year increase of 63% and a month on month increase of 1.5%. The domestic retail share of independent brands was 48.2%, a year-on-year increase of 1.7 percentage points. It is not difficult to speculate that by the end of December, the overall market share of domestic brands will exceed 50%.

Among independent brand car companies, there are only a few that are truly competitive. For example, in April, among the top 30 domestic car companies in terms of sales, Chang'an, ranked fourth, had a sales difference of nearly 40000 vehicles compared to Great Wall, ranked fifth. The cumulative sales volume of Great Wall Motor from January to April was only 245000, lower than that of SAIC passenger cars.

So the hope of independent brands should still be pinned on car companies with monthly sales of over 100000 vehicles. Conversely, for independent brands that did not achieve growth in April, it is time to reflect carefully. For example, Zero Run, Dongfeng Fengshen, Xiaopeng, Dongfeng Xiaokang, and Celes are being seized by other car companies.

If we look at the declining data, it is actually foreign car companies that are doing better. Whether it is German, Japanese, or American, there is no declining car company in the statistical data available. The main reason why foreign brands are able to perform so tenaciously is that the promotion rate at the end has not weakened, thus blooming everywhere.

In April, mainstream joint venture brands retail 610000 vehicles, a year-on-year increase of 35% and a month on month increase of 12%. In April, the retail share of German brands was 21.6%, a year-on-year increase of 2.3 percentage points, while the retail share of Japanese brands was 18.7%, a year-on-year decrease of 5.7 percentage points. The retail market share of American brands reached 8.4%, a year-on-year increase of 1.9 percentage points.

For example, the Volkswagen series often offers discounts starting at 30000 yuan, which have a very considerable appeal. However, this also led to subsequent issues with the preservation rate. Data shows that against the backdrop of a decline in the overall preservation rate of second-hand cars, the preservation rate of mainstream joint venture brands has decreased, while the preservation rate of luxury brands has generally decreased.

Although Japanese car companies had great success in April, their retail share was 18.7% due to the impact of domestic brands and slow electrification transformation. This was a year-on-year decrease of 5.7%, making them the only car series among the three major car series to have fallen against the trend. Extending the timeline to the entire January April period, the cumulative sales of each car company have all experienced a decline.

Unlike German brands' resolute counterattack in the field of new energy, Japanese brands previously appeared somewhat Buddhist. However, Japanese car companies, including Honda and Toyota, are currently accelerating the process of layout electrification. As for whether Japanese car companies can regain some market share in the domestic market through accelerated layout electrification transformation, more time and market validation are still needed.

When it comes to American cars, most people may first mention General Motors, followed by Ford. Now this concept may change, with Tesla China's cumulative sales reaching 300000 units from January to April, surpassing SAIC GM in one fell swoop, leaving little time for General Motors and Ford, which can represent the traditional American automotive industry.

As a wholly-owned company and a new energy vehicle enterprise, Tesla finds it difficult to represent traditional American car brands. In fact, this is also true for many car companies. In the fierce collision between globalization and localization, it is difficult to determine whether the ultimate success is globalization or localization. But the only reality is that as long as you are in the Chinese market, you must play according to the rules of the Chinese market.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!