On April 6th, PwC released a report titled "Review and Future Prospects of China's Automotive Industry M&A Activities in 2022". Data shows that in 2022, the automotive industry continued to attract capital attention, with a merger and acquisition transaction amount of over 371.4 billion yuan and a total of 666 transactions, an increase of 1% and 22% respectively compared to the previous year. Automotive components have become the most lucrative race track, receiving a considerable amount of investment.

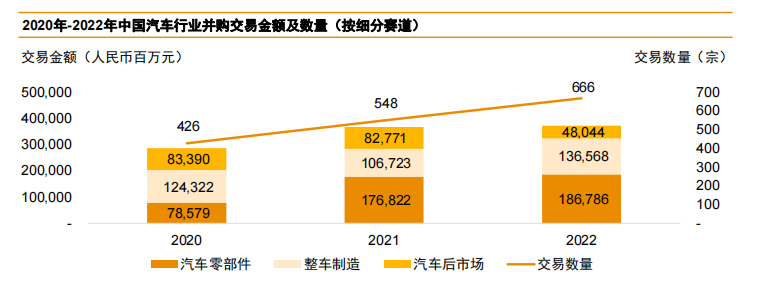

Looking back on 2020 to 2022, the number of mergers and acquisitions in China's automotive industry has maintained continuous growth; The trading scale has broken through the trend and made steady progress. Driven by various positive factors such as energy transformation promoting industrial upgrading and intelligent transformation, as well as strong guidance from industry policies, investment vitality tends to increase.

In the past year, despite experiencing macroeconomic negative factors such as geopolitical turmoil and overall economic growth slowdown, the automotive industry has remained hot and positive policies have continued to be implemented. According to statistics, in 2022, there were over 40 national level proposals to ensure the stable development of the automotive industry. The latest policies released in 2022 include a series of measures aimed at boosting consumer confidence, accelerating industry commercialization closed-loop, and safeguarding vehicle operation safety; At the same time, from the perspective of national mid to long-term planning and goals, the automotive industry will benefit from policy guidance such as low-carbon environmental protection, innovative development, and infrastructure construction. Under the strong guidance of policies, the Chinese automotive industry will continue its vigorous upward momentum and will greatly promote and accelerate economic recovery.

Jin Jun, the managing partner of the automotive industry in mainland China and Hong Kong at PwC, stated: After facing numerous challenges, technological innovation is not only a development path that the automotive industry has always adhered to, but also an unchanging foothold in investment logic. Keeping the clouds open and the moon shining, accompanied by the stabilizing prices of major raw materials represented by mineral resources, the acceleration of domestic substitution of core automotive components, and the reshaping of supply chain resilience, as well as the intensive introduction of policies to stabilize growth and promote consumption, the automotive industry has a promising future

Under the industrial transformation and upgrading, as battery systems and new energy vehicles continue to attract capital markets, the number of giant transactions exceeding 10 billion yuan in the automotive industry in 2022 increased by 40% compared to the previous year, contributing over RMB 146.9 billion in transaction amount and an average transaction size of RMB 21 billion, an increase of 56% compared to the previous year. However, at the same time, the average trading volume of various orders of magnitude below 10 billion yuan reflects varying degrees of decline, especially in large transactions, with a decrease of over 10%, indicating that industrial investors are more cautious in their investment attitude towards large transactions.

In terms of the distribution of transaction rounds, strategic investment or investment in the acquisition stage accounted for the largest proportion in terms of scale and quantity during the statistical period, playing a leading role in the overall M&A transaction, indicating that the maturity of the leading companies in the industry is getting stronger, releasing funds to speed up the pace of restructuring, transformation and combinatorial optimization optimization. Among them, the vehicle manufacturing track is more likely to win early investment due to its deeper industrial background, strong competitiveness and growth potential of enterprises.

From the distribution of transaction types, the overall proportion of strategic investments has increased. Domestic M&A transactions are mainly focused on financial investment, with financial investors focusing on exploring market opportunities in the fields of batteries, autonomous driving, intelligent connectivity, and other components, seeking investment returns driven by technological innovation and value appreciation; Cross border investment is mainly manifested in the acceleration of industry layout by strategic investors, and the cross-border integration with the energy chemical industry and industrial manufacturing industry is also showing a positive trend.

In terms of the regional distribution of mergers and acquisitions in the automotive industry in 2022, under various comprehensive factors such as overall industrial layout, first mover advantage, industrial chain integrity and supply chain elasticity, policy support and tilt, and attractiveness to talent, capital has been active in the Yangtze River Delta, Guangdong Hong Kong and Macao regions for a long time and has shown a significant gathering trend.

From the perspective of segmented tracks, the number of completed transactions for automotive parts in 2022 was 460, a significant increase compared to the previous year. Electric vehicle components are still favored by capital, and battery mergers and acquisitions are hot. Traditional automotive component mergers and acquisitions are still active, with a 42% increase in transaction volume compared to the previous year. Electrification, intelligence, networking, and lightweight have penetrated into investment strategies as the development core of the automotive industry transformation. The entire vehicle manufacturing process has completed 68 transactions, contributing a transaction amount of 136.6 billion yuan. Among them, there were 5 transactions exceeding 10 billion yuan. The acceleration of early financing and listing of new energy vehicles has greatly promoted the overall level of mergers and acquisitions in the automotive industry. After 2022, the market service sector has been affected by the macro environment, resulting in a cooling down in M&A transactions, with a 42% decrease in transaction amounts compared to the previous year. With the vigorous development of new energy and intelligent vehicles, it is bound to stabilize and rebound, help downstream services form new growth points, broaden the service value chain, and drive investment recovery to accelerate.

The report predicts that the future development trends of the automotive industry will focus on low-carbon development and cost reduction and efficiency enhancement in the entire vehicle manufacturing process; With the continuous increase of market penetration of highly integrated components, the gold absorption scale of the track is expected to increase. The commercial implementation feasibility of consumer perception related components in the field of intelligent cockpit is higher. Autonomous commercial vehicles have a wide range of application scenarios and a considerable market size, and are expected to continue to receive capital support.

In addition, as Chinese entities such as car and battery companies accelerate their outbound mergers and acquisitions to alleviate supply chain pressure, occupy overseas markets, and gain cost advantages, outbound mergers and acquisitions may significantly increase; At the same time, thanks to the thriving innovation soil of intelligent automotive components, inbound mergers and acquisitions of automotive technology enterprises are also expected to become a hot topic.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!