On September 29, Porsche was listed on the Frankfurt Stock Exchange. The second largest IPO in German history and the third largest IPO in European history made Porsche the third super luxury brand to enter the capital market after Ferrari and Aston Martin.

Finally, Volkswagen set the listing price of Porsche at 82.5 euros per share, and the valuation of Porsche brand reached 75 billion euros after listing. During the golden week of the National Day, Porsche's share price soared to 93 euros per share, and its market value rose to 85 billion euros. Its market value surpassed Volkswagen Group, and it became the largest automobile manufacturer in Europe after Tesla, Toyota and BYD.

As we all know, Porsche has become the "cow" of Volkswagen Group since it was acquired by Volkswagen, and it is one of the most profitable brands under Volkswagen Group. Even if the interests of automobile manufacturers are impaired due to the epidemic, Porsche can still export stably.

The data shows that Porsche's sales volume in 2021 will contribute nearly 30% of the profit when only 3.3% of the total sales volume of Volkswagen Group. In the first half of this year, Porsche achieved a sales revenue of 17.92 billion euros, up 8% year on year; Operating profit was 3.48 billion euros, up 24.6% year on year; The sales profit margin is 19.4%, and the data growth is still considerable.

In this context, the success of Porsche's listing has attracted the attention of capital, and its market value has even exceeded that of its parent company, Volkswagen Group. As a luxury brand under VW and one of VW's "profit cows", Audi's IPO becomes more subtle.

Possibility created by Porsche

For Volkswagen Group, there are many brands, including Audi, Bentley, Lamborghini and Bugatti, in addition to Porsche. After the IPO of Porsche, rumors that subsidiaries including Audi may be listed spread widely, which is also normal.

Why was Audi the first to be heard?

It is not difficult to understand. After all, in the discussion of profit for the Volkswagen Group, Audi, which can make both volume and profit, is often mentioned at the same time as Porsche.

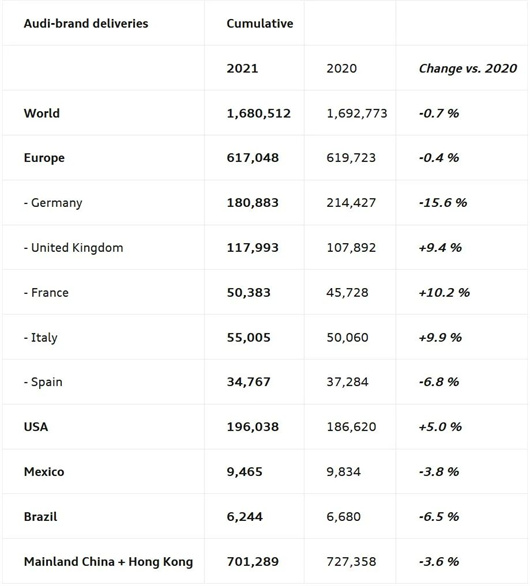

According to the situation in 2021, Audi's global sales volume is 1693000 vehicles, with a sales volume of 53 billion euros, and achieves record operating profit and net cash flow. Among them, the operating profit was 5.498 billion euros, and the net cash flow was 7.8 billion euros.

Therefore, after Porsche's successful IPO and its record of market value, whether Audi's IPO will be put on the development charter of Volkswagen Group has become a hot topic.

As for the news of Audi's IPO, Arno Antlitz, the chief financial officer of Volkswagen Group, chose to refute the rumors online, denying that the listing of Porsche may lead to the listing of Audi.

At the same time, Antlitz changed the subject. During the Porsche launch conference, he said that Volkswagen planned to establish a partner in the next one to two years as the first step to promote the listing of its PowerCo battery business.

Antlitz revealed, "We do not rule out the possibility of PowerCo's initial public offering (IPO), but our current financial flexibility is only enough to support us to independently complete the work of strengthening the battery field. After that, we will consider gradually increasing strategic partners. At present, I cannot disclose more information."

In other words, while denying that Audi will be separated, Volkswagen Group also said that the battery sector may have an IPO.

It is worth mentioning that as early as last May, Herbert Diess, the former CEO of Volkswagen, had put forward the idea of listing the battery business and hoped to realize the purpose of raising funds for the expansion plan of Volkswagen's battery business.

Volkswagen Group also invested more than 20 billion euros in the battery business. PowerCo is responsible for managing its battery production and research and development, including mining, recycling and energy storage systems. At the same time, Volkswagen Group also reserved 10 billion euros for the purchase of cathode materials and other supply chain investments.

If oil is the industrial "blood" in the era of fuel vehicles, then batteries are the driving force on the new energy track.

At present, for the overseas part of Volkswagen, power batteries are mainly supplied by LG Chem, SKI and Samsung SDI; In China, Ningde Times is its main battery cell supplier, and the battery system is produced by two joint ventures, North and South Volkswagen. In addition, Volkswagen also signed contracts for the purchase of lithium battery equipment and raw materials with Pioneer Intelligence, Ganfeng Lithium, Tianqi Lithium and other enterprises.

If Volkswagen's battery business is successfully IPO, it means that Volkswagen's battery department will become an independent battery supplier in the future, which shows Volkswagen's great ambition in the battery field and its determination to lead the development of battery business in the future.

In addition to Audi and PowerCo, the battery business department, such as Lamborghini and CARIAD, the software department, do not rule out the possibility of independent listing in the future, which is created by Porsche IPO.

People raise money, more is better

When more subsidiaries and business departments take the path of IPO, it is for VW Group to consider its long-term interests.

Take the IPO of PowerCo as an example. At present, Volkswagen's electrification strategy is still in the initial stage. In order to achieve the goal of cost reduction and efficiency increase, the expansion and diffusion of battery business can help Volkswagen achieve more levels of extension, thus expanding the scope of profit, so that it is not only betting on battery business or electric vehicle sales business.

As mentioned above, the expansion of business reveals the great ambition of Volkswagen in relevant fields and its determination to lead the future business development. It is equally important for the public to expand the scope of profit.

As we all know, among the traditional auto giants, Volkswagen's electric transformation is undoubtedly resolute. From its decision to delay the release of the eighth generation of golf, we can see that Volkswagen ID. 3 is the first model of Volkswagen's new LOGO.

One of the most significant features of the electrification transformation is "burning money".

In terms of new domestic car making forces, Li Bin, CEO of Weilai, once said that an electric vehicle enterprise needs at least 20 billion yuan to reach mass production, and He Xiaopeng, Chairman of Xiaopeng Automobile, also said that 20 billion yuan is not enough; In terms of traditional car enterprises, several independent brands, including Chery "Yaoguang 2025", have released the 2025 strategy, and the scale of investment is also at the level of 100 billion

Even the new domestic car making force with an annual sales volume of 100000, and the traditional car enterprises that have just turned to the five-year plan, are so "burning money", let alone the elephant Volkswagen. It can be seen that capital is very important for the cause of electric transformation.

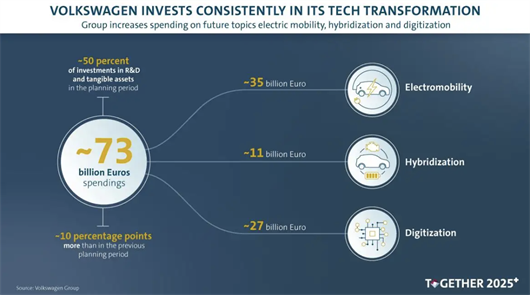

Volkswagen Group also announced in July last year that it would invest 159 billion euros in a new round of five-year plans. Among them, 89 billion euros will be used for software and electric vehicle technology, accounting for more than half of the total investment. In particular, the expenditure on electric vehicles will increase by about 50% to 52 billion euros.

At the same time, it is important to know that electric transformation is a long-term undertaking, and capital investment cannot be achieved overnight.

For example, in the Chinese market, Volkswagen plans to jointly invest about 15 billion euros with joint venture partners from 2020 to 2024 to accelerate the layout of China's electric travel field; Previously, it was reported that Volkswagen wanted to acquire Huawei's autonomous driving department at a price of billions of euros; At present, we are investing 1 billion euros (some say US dollars) to launch a software joint venture in China

With regard to the electrification transformation, Volkswagen Group has too many places to spend money. With the decline of performance and large investment in new energy, the pressure on Volkswagen Group's capital chain is self-evident.

Therefore, Porsche, the "profit cow", went to Frankfurt Stock Exchange to realize its IPO with the mission of raising funds for the electrification transformation of Volkswagen Group. Porsche did not disappoint Volkswagen after its listing. According to the data, the IPO of Porsche brought 19.5 billion euros to Volkswagen Group. This fund is undoubtedly a timely help to Volkswagen Group, which is currently short of money.

Volkswagen, who has tasted the benefits, will not stop. After the IPO of Porsche, if the PowerCo battery subsidiary is successfully listed independently, the department is expected to achieve a sales volume of 20 billion euros in 2030, which is another huge income.

Therefore, the news about the listing of Audi, Lamborghini and other business departments has been constantly spread out in Porsche's IPO. It can be said that Porsche "gets its way", which makes it possible for Volkswagen's subsidiaries to rise to the sky.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!