Since the auto market entered the downward track in 2018, the survival status of dealers has been deteriorating. Increasing inventory pressure, shrinking new car profits, and declining profitability have gradually become the industry norm. Entering 2020, the sudden new coronary pneumonia epidemic disrupted the pace of the entire auto market, resulting in dealer operations being blocked, cash flow scarcity, and a crisis of survival.

Increased losses and serious price inversion

All along, dealers have a single profit model. Many small and medium-sized dealers basically rely on car companies' preferential policies and performance rebates. Whether the sales target can be achieved directly determines their profitability. During the upward period of the auto market, the purchasing power was strong, and the dealers were relatively nourished. However, as the auto market shifts from increments to stocks, consumers' willingness to purchase declines, and it becomes increasingly difficult for dealers to achieve sales targets.

According to the "National Automobile Dealership Survival Survey Report 2019" recently released by the China Automobile Dealers Association, the proportion of dealers who completed the annual sales target in 2019 was only 28.9%, and another 7.4% of the dealers ’target completion rate Below 50%. In terms of profitability, compared to 2018, the loss face of dealers in 2019 expanded to 41.0%, the loss ratio increased significantly, and the proportion of profitable dealers decreased to 29.7%.

Image and data source: China Automobile Dealers Association

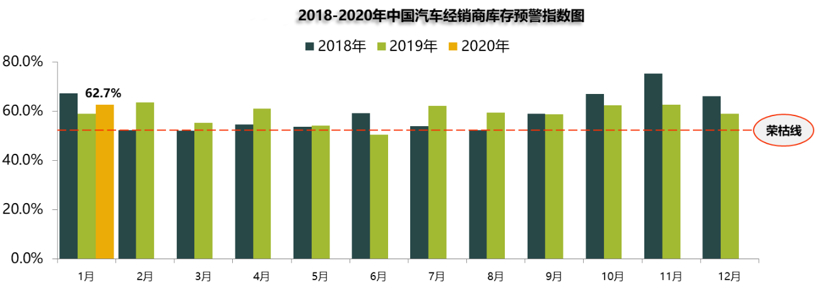

At the same time, we see that the sales tasks assigned by car companies are still rising, and the inventory pressure of dealers is increasing. From the following 2018 ~ 2020 dealer inventory early warning index chart, we can see that, in addition to the large amount of inventory released during the National Five to National Six last June, the inventory coefficient in most other months is above the warning line.

Image and data source: China Automobile Dealers Association

In this situation, the pressure on dealer funds and operations has increased. In order to digest the inventory and maximize the sales target, the dealers had to endure painful price reductions, and even "price upside down" (terminal sales price is lower than the market wholesale price). In the survey sample of the Automobile Dealers Association, nearly 80% of dealers in 2019 experienced price inversions, of which the joint venture brand was the most serious. As a result, the profit of new car sales fell further. The data shows that the profit of new car sales in 2019 accounted for only 3.4% of the total profit.

In response to this, the National Federation of Industry and Commerce Auto Dealers Chamber of Commerce published the "Proposal to Passenger Car Manufacturing Enterprises" in 2019, calling on passenger car manufacturers to rationally and objectively view the changes in supply and demand in the Chinese market and pursue the "sales" transformation In order to pursue "efficiency" and "efficiency", we will effectively change "sales-based production" from the slogan to the company's business guidelines, and formulate scientific sales targets and business policies based on full communication with dealers.

Cash flow is under pressure, half of the companies are less than 3 months to support

Since the beginning of 2020, affected by the new crown epidemic, dealers have shown a steep decline in new car sales, leasing, and after-sales service. The overall operation is under pressure, and the cash flow that can be used for activities is gradually drying up.

Judging from the survey results of the Automobile Dealers Association, 50% of the dealers said that the cash flow could still support 1-3 months, and 27% of the dealers revealed that the existing funds were less than one month of expenditure. Under the pressure of funds, the rate of withdrawal of dealers from the Internet has further accelerated. According to data released by the Channel Development Branch of the China Automobile Dealers Association, the luxury brand licensing network has confirmed the closure of 21 stores in the first two months of this year (which does not include dealers who are engaged in equity transactions), and it is expected that the withdrawal phenomenon will continue in the first half of the year. .

In order to alleviate the pressure on dealers, during the February epidemic, major auto companies have put down the "sales theory" and canceled the assessment tasks for the month or the first quarter. Some car companies have also introduced relevant subsidy policies to help dealers get through the difficulties. For dealers, it is not easy for car companies to lend a helping hand when their own operations are difficult. However, it is difficult to fundamentally ease the financial difficulties. It is worth mentioning that with the full recovery of the assessment of auto companies in April, dealers will also face financial pressure to raise cars.

In addition, affected by the epidemic situation at home and abroad, the overall economic downturn, consumers 'willingness to purchase and purchasing power have declined, which is also a big challenge for the dealers' subsequent sales increase and capital recovery.

In order to minimize operating losses, according to the survey, nearly 10% of dealers intend to resell, flop, and trust storefronts. The good news is that out of optimism about the future prospects of the automotive industry, there are still investors who are willing to invest and buy. Among the luxury / import brands, the investors' intentional brands are mainly Lexus, BMW, Mercedes-Benz, and Audi; the joint venture brands are mainly concentrated in Toyota , Honda, Nissan, Volkswagen; independent brands tend to Hongqi, Geely.

Overcome and persevere in crisis

The epidemic's impact period is uncertain, sales continue to decline, and profits will definitely decrease. For dealers, how to survive has become the current top priority. To this end, we see that most dealers have taken the initiative to seek changes to meet new challenges.

In this process, the most prominent move is online marketing. During the epidemic in February, due to operating pressure, many dealers quickly moved to the front line and launched sales and after-sales services through VR exhibition halls, live broadcasts, WeChat and other zero-contact methods. According to the recently released "Car 2020 Live Ecology Report" released by Rider Chedi, after February 16, the average number of single-day broadcasts on the Rider Chedi platform remained above 2,000, and the proportion of dealer anchors started broadcasting from the Spring Festival. 1% has increased to the current 86%.

Although from the perspective of effectiveness, online marketing has not brought too much real benefits to the enterprise in the short term, but many dealers have harvested a large number of sales leads in this process, and some have even found out "doorways", which has led to transactions. Fast conversion. According to statistics from Chedi, 90% of viewers' comments are mostly related to models and brands, and 60% of user reviews are directly related to select purchases.

Image source: A live screenshot of a 4S shop of FAW Toyota

In addition to online marketing, many dealers have also increased their profitability by expanding financial services and optimizing after-sales services. In general, under multiple challenges and pressures, it is imperative for dealers to transform and upgrade and optimize profit models. Especially under the influence of the epidemic, industry reshuffle will intensify. Under the market rules of the strong and ever-strong, the strategy will be followed, and the dealers who have passed the test will be expected to usher in an opportunity to enter a new cycle of more stable development; and Some dealers with insufficient funds, single profit, disordered management, and slow transformation of new retail may be out of the market early.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!