Scan QRCode

In 2025, Chinese automobiles will demonstrate strong resilience and vitality in the face of challenges when going global. According to data from the China Association of Automobile Manufacturers, from January to November 2025, China's total automobile exports reached 7.33 million vehicles, a year-on-year increase of 25%, reaching a new high. The annual export volume is expected to exceed 8 million vehicles. Under the overall trend of improvement, the internal structure of exports has also undergone changes, with the former "champion" market cooling down and new growth poles rapidly emerging... China's automobile overseas pattern is undergoing a reshaping.

Russia plummets, Europe, Mexico fill positions

It once ranked first in China's automobile exports for two consecutive years in the Russian market, with the most drastic transformation. Data shows that from January to November 2025, China's automobile exports to Russia amounted to 513100 units, a year-on-year drop of half, and a significant contraction in export scale, causing the ranking to drop from first to second place. The direct reason for this "cliff like" decline is the Russian government's protection of the domestic automotive industry. Since October 2024, Russia has continuously raised the scrap tax on imported cars, with tax rates increasing by 70% -85%, resulting in a general increase in the terminal selling price of Chinese imported cars and a serious weakening of their cost-effectiveness advantage. In addition, the high benchmark interest rates maintained by Russia to combat inflation have led to high costs of consumer credit for automobiles, resulting in a cooling of overall market demand. From January to November 2025, the cumulative sales volume of the Russian car market was 1.33 million units, a year-on-year decrease of 21%. In sharp contrast to Russia's contraction, the European market is growing under high tariff pressure. In October 2024, the European Union imposed a maximum of 35.3% countervailing duty on Chinese made pure electric vehicles, which, combined with the existing 10% basic tax, resulted in punitive tariffs of up to 45.3%. However, trade barriers have not prevented Chinese cars from entering. According to European market research firm Dataforce, in November 2025, Chinese brand cars sold 78358 units in Europe, a year-on-year increase of 108%, contributing to an overall market share of 7.4%. This is thanks to Chinese car companies quickly adjusting their product structure and finding a breakthrough in European tariff barriers. The high tariffs imposed by the European Union mainly target pure electric vehicles, while the standard tariffs on plug-in hybrid electric (PHEV) and hybrid electric (HEV) models are still only 10%. Therefore, Chinese car companies are rapidly increasing their investment in related vehicle models. In addition to flexible strategies, the improvement of the competitiveness of Chinese automobiles themselves is fundamental. By 2025, over 20 Chinese car models will receive the highest five-star rating in the rigorous Euro NCAP safety testing, which will to some extent change the stereotypical impression of Chinese cars in the European market. At the same time, leading companies such as BYD and Chery are accelerating the establishment of factories in Europe to build long-term competitiveness through localized production. It is worth noting that by 2025, China's automobile industry will break away from its dependence on a single market and form a diversified situation of "multi-point blooming". The space left by Russia, the traditional main market, was quickly filled by other markets. Mexico has replaced Russia with an export volume of 573500 vehicles, becoming the largest single market for Chinese automobile exports for the first time. For Chinese car companies, Mexico is not only an important single market, but also an important springboard for Chinese car companies to enter the North American market. The United Arab Emirates ranks third among China's export destinations with 465500 vehicles, and the Middle East market is becoming an upward market for China's automobile exports. In addition, Brazil and Australia in the southern hemisphere market have risen in rank, ranking fourth and sixth respectively, with exports to Kazakhstan of 188000 vehicles. Kazakhstan has entered the top ten export destinations and become one of the fastest-growing "dark horses". In Southeast Asia, Chinese brands are also growing rapidly. For example, in the Indonesian market, the cumulative sales of Chinese brand cars from January to October 2025 reached 82436 units, doubling year-on-year, and the market share significantly increased from 5.8% last year to 13%. From a regional perspective, from January to November 2025, China's automobile exports to Africa will increase by as much as 110% year-on-year, while exports to Oceania will increase by 69% year-on-year. Exports to Southeast Asia, Central and South America, and other regions will also maintain a growth rate of over 40%. The collective rise of these emerging markets marks a more balanced and stable global landscape for China's automobile exports.

Not only selling cars, but also 'sitting on the table'

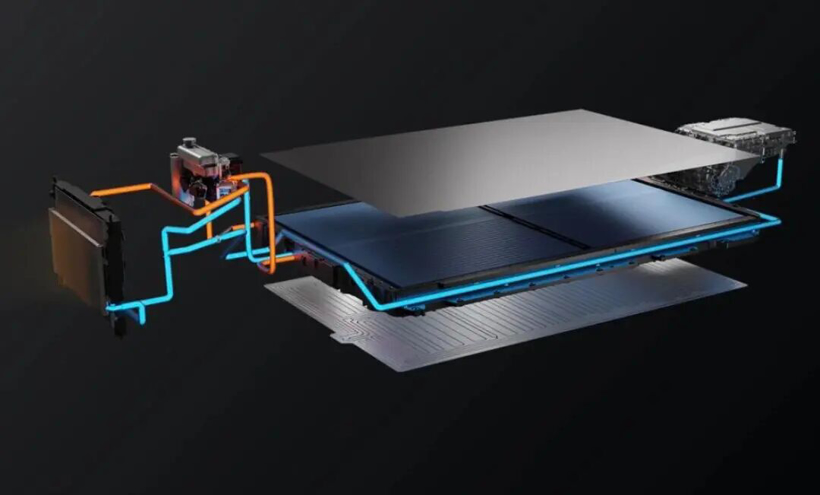

Nowadays, the globalization process of China's automobile industry has entered the "second half" with system competitiveness as the core. With the further deepening of the "second half", there have been new changes in China's automobile exports to the outside world. According to data from the China Association of Automobile Manufacturers, from January to November 2025, China's new energy vehicle exports reached 3.01 million units, a year-on-year increase of 62%. Among them, plug-in hybrid vehicles accounted for 13% of the total automobile exports, an increase of 8 percentage points year-on-year. In contrast, the proportion of exports of pure fuel vehicles decreased by 11 percentage points year-on-year. This increase and decrease is enough to clearly outline the trajectory of energy transformation. In this way, a structural change is clearly visible: new energy vehicles are increasingly becoming the growth pole for Chinese cars to go global, and PHEV models have emerged as a "rising force" with a growth rate faster than all power types. The explosive growth of plug-in hybrid models is the result of a precise match between market strategy and global demand. Faced with high tariffs imposed on Chinese pure electric vehicles by some markets led by the European Union, Chinese car companies have to tilt the export focus of new energy vehicles towards plug-in hybrid models. In addition, the technical characteristics of PHEV models also accurately match the actual needs of diversified markets. For emerging markets such as Southeast Asia, the Middle East, and Latin America where charging infrastructure is still under construction, PHEV's "oil and electricity" characteristics can effectively solve the problems of mileage and energy replenishment. Anxiety has become an ideal choice for the target market to transition from traditional fuel to pure electric. In addition to changes in the energy structure, the business model of Chinese automobile exports overseas is also undergoing transformation. By 2025, China's automobile exports will have gone beyond the stage of mainly focusing on whole vehicle trade, and will shift towards "manufacturing exports" and "ecological exports". The export model will shift from selling cars to building ecosystems, and the layout planning will also shift from assembling parts to localizing the supply chain.

Take BYD as an example, it has already established localized production in major mainstream markets around the world. For example, BYD has built a factory in Szeged, Hungary, and the equipment has been delivered, installed, and debugged. It is planned to start production in 2026 to radiate the entire European market; The factory in Rayong Province, Thailand has achieved localized production in 2024, becoming an important manufacturing hub serving the Southeast Asian region. This global localization investment in heavy assets is enough to demonstrate BYD's transformation from "selling products" to "building production capacity". Among Chinese car companies, BYD is not the only one doing this. Independent car companies such as Chery, Great Wall Motors, Geely, as well as new forces such as Xiaopeng and Leapmotor, are all doing the same. With the deepening of localization in manufacturing, China's automobile going global is no longer a solo effort of vehicle companies, but a collective going global of collaborative industrial chains. It is reported that following BYD's industrial layout in Thailand, a large number of Chinese upstream component and service supporting enterprises have successively invested and built factories. According to survey company MarkLines and relevant data from the Thai government, as of March 2025, the number of Thai automotive component companies established with Chinese investment has surged from about 48 at the end of 2017 to 165, which is 3.4 times higher than before, and has initially formed a large-scale industrial cluster. CATL's investment in Indonesia has not only built advanced battery factories, but also covered nickel mining and battery material production upstream, building a vertically integrated ecosystem from mineral resources to end products. In this series of actions, Chinese companies have shifted their exports from product output to the output of Chinese technology standards and industrial systems, thereby occupying more initiative in the global automotive industry value chain.

The tough battle of going out to sea still needs to be fought

Behind the impressive export data and grand global narrative, Chinese cars still face enormous challenges in going global. In Europe, where the automotive industry has a long history, building brand awareness is also a long-term battle for Chinese car companies, in addition to the high tariffs and walls erected. BBA、 Local brands such as Volkswagen have been deeply ingrained in the bones of local consumers, and generally have a low acceptance of foreign brands. According to authoritative surveys, more than half of German respondents still prefer to purchase European brand cars, and only nearly 10% of German car owners say they will consider Chinese brand cars in the future. In addition, many Chinese brands' after-sales networks are still in the early stages of construction. In major European countries, the number of service centers is much lower than that of traditional giants, resulting in a shortage of parts supply and maintenance efficiency, which further affects user experience and brand reputation. In Southeast Asia, which seems like a "water tower", Chinese car companies are facing a deeply rooted market structure. Before Chinese car brands launched a large-scale attack on the Southeast Asian market, Japanese brands had been deeply rooted here for decades. Whether it is brand awareness, supply chain system, sales and service network, they are more stable than Chinese brands and have long occupied nearly 80% of the market share. In the past two years, the market share of Japanese brands in Southeast Asia has gradually been eroded by Chinese brands, showing a downward trend. According to statistics, in the first half of 2025, Japanese brands will have a sales share of 62% in the six major markets in Southeast Asia. Despite the rapid growth of Chinese electric vehicle sales in markets such as Thailand and Indonesia, for example, from January to November, Chinese electric vehicles accounted for 80% of the Thai electric vehicle market. However, from the perspective of the overall passenger car market, the market share of Chinese brands is still low, and disruptive breakthroughs still need time.

The rapid construction boom of Chinese brands has also exposed the problem of shallow localization foundation. In Thailand, many Chinese electric vehicle brands still heavily rely on imported components, especially the three electric system, from China. This leads to a maintenance cycle of several weeks in case of critical vehicle malfunctions, seriously affecting user satisfaction, which are intangible challenges. Looking at the changes in the Russian market for Chinese cars, the market gap left by the withdrawal of foreign investment has led to the emergence of Chinese cars. However, due to changes in domestic policies in Russia, exports to Russia have rapidly shrunk. This practical example has taught Chinese car companies a lesson on "policy risk": opportunism caused by policy changes is not common and can easily collapse in an instant. Sustainable going global requires building deep competitiveness centered on localized manufacturing, technological adaptation, supply chain integration, and brand value. In emerging markets such as South America, the Middle East, and Africa, the United Arab Emirates and Brazil remain among the top five destinations for China's automobile exports, while Mexico, Australia, and others also rank among the top ten... These markets are becoming new engines of growth for China's automobile exports. But at the same time, behind the growth opportunities, Chinese automobiles are also facing systematic challenges. Firstly, there is a high degree of uncertainty in policy and trade environment. Taking Brazil as an example, its import tariffs on new energy vehicles are being raised in stages, with plans to increase to 35% by 2026. In addition, Chinese automobiles also face constraints in terms of immature infrastructure and industrial chains in export destinations, with Africa being a typical representative. In Africa, the lack of charging networks and unstable power supply are the primary obstacles to promoting new energy vehicles. For example, although the Mexican market is a major springboard for Chinese cars to penetrate deep into North America and has a good supply system for the automotive industry, how to face policy risks, integrate into local culture, and achieve better product localization and adaptation? These are the real problems that Chinese car companies face when going global.

Summary of Car Cloud

The second half of China's automobile going global can be said to be a difficult transition from "opportunistic trade" to "systematic deepening". True globalization means meeting the highest global standards in technology, branding, and compliance. In the future, success will no longer depend on the ability to capture a blank market, but on the ability to simultaneously complete complex projects such as manufacturing localization, supply chain integration, technical standard output, and long-term brand building on a diverse and differentiated global chessboard. This test is not only about the cost-effectiveness of products, but also about the long-term battle, real effort, and hard power of China's automotive industry to build a global competitive system.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!