Scan QRCode

The Chinese car market in 2025 has gone through a magnificent year under the strong promotion of the national subsidy policy. Data shows that from January to November this year, the total number of cars exchanged for new in China exceeded 11.2 million, and the policy of "red envelope rain" effectively nurtured the prosperity of the car market, driving related consumption of over 2.5 trillion yuan and benefiting more than 360 million people. The policy of exchanging old for new has directly promoted the growth of automobile consumption. In the first 11 months of 2025, domestic automobile sales increased by 11.4% year-on-year, among which new energy vehicles performed outstandingly, with sales reaching 14.78 million units, a year-on-year increase of 31.2%; The policy scale is expected to exceed 180 billion yuan, coupled with measures such as tax reductions and exemptions for new energy vehicle purchases, providing strong support for the market. However, as December approaches, with the gradual depletion of annual subsidy amounts and the emergence of consumer wait-and-see sentiment, the terminal market has quietly shown signs of weak growth, and the industry generally feels the chill before the "policy window period".

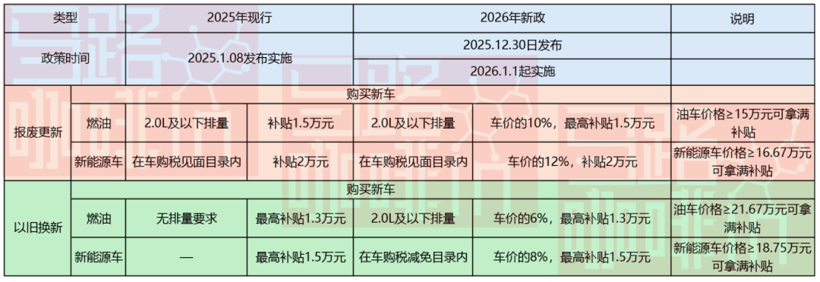

At a critical moment when major car companies are preparing for New Year's Day promotions and the market is looking forward to a new round of policy guidance, on December 30th, the "Implementation Rules for the 2026 Automobile Trade in Subsidy" jointly issued by seven departments including the Ministry of Finance and the Ministry of Commerce was like a "timely rain", accurately dripping the slightly anxious car market at the end of the year. Upon closer inspection, this highly anticipated new policy has made adjustments in various aspects such as subsidy scope, subsidy standards, and implementation mechanisms. It not only continues the subsidy intensity, but also makes important optimizations in direction and mechanism, ushering in a new stage of more precise and high-quality development of automobile consumption promotion policies. Based on the continuation and optimization of subsidies, the industry generally believes that the new policy will effectively stabilize the traditional off-season fluctuations and inject a shot in the arm for a stable start to the car market in 2026.

01 subsidy seamless connection, more precise and reasonable

On December 30th, the National Development and Reform Commission and the Ministry of Finance issued a notice on the implementation of large-scale equipment updates and the policy of exchanging old for new consumer goods by 2026 (referred to as the "Notice"). The notice mentions automobiles multiple times, among which the update of the national subsidy policy for automobiles has received great attention. Overall, the core of the 2026 car trade in subsidy policy lies in three dimensions: continuing the total amount, optimizing the subsidy structure, and strengthening full process supervision. Its specific details also show very distinct characteristics. Firstly, the new policy introduced for the first time a differentiated subsidy calculation method linked to new car prices, aimed at encouraging mid to high end consumption and promoting the value enhancement of the automotive industry.

In the purchase of new cars from scrapped old cars, the subsidy for new energy passenger vehicles is 12% of the new car price, with a maximum limit of 20000 yuan. This means that if the purchase price reaches or exceeds 166700 yuan, you can enjoy a full subsidy of 20000 yuan; For fuel vehicles with a displacement of 2.0 liters or less, a subsidy of 10% of the new car price will be provided, with a maximum cap of 15000 yuan. If the purchase price reaches or exceeds 150000 yuan, a subsidy of over 15000 yuan can be obtained. In the transfer of old cars to purchase new cars, new energy passenger vehicles will receive a subsidy of 8% of the new car price, with a maximum cap of 15000 yuan. To enjoy the top tier subsidy, the purchase price must reach 187500 yuan or more; The subsidy for fuel vehicles with a displacement of 2.0 liters or less is 6% of the new car price, with a maximum cap of 13000 yuan. The threshold for purchasing a car is set at 216700 yuan. It is not difficult to see that compared with the "one size fits all" quota or proportional subsidies in 2025, the new policy in 2026 combines "inclusiveness" and "guidance" by setting subsidy ceilings and implicit price thresholds. On the one hand, all eligible consumers can still enjoy tangible subsidies; On the other hand, policy resources are more inclined to encourage consumers to choose higher value car models. This directly responds to the structural problem of "a surge in low-priced car sales but weak industry profit growth" that will occur in 2025, aiming to promote the transformation of the car market from quantity expansion to quality improvement. This is more advantageous for brands with a high concentration of mid to high end vehicle models and high technological added value in their product line layout.

In addition, the new policy particularly emphasizes "optimizing the allocation of funds, improving the implementation rules of the entire chain", and explicitly proposes "cracking down severely on illegal and irregular behaviors such as fraudulent subsidies and 'raising prices before subsidies'". In response to the possible behavior of dealers temporarily raising prices and diluting subsidy dividends before the policy is introduced in previous years (i.e. "raising first and then supplementing"), the new policy will curb it by strengthening price monitoring, clarifying reference benchmark prices, and establishing a reporting and verification mechanism. At the same time, according to previous reports, behaviors such as "scalpers" robbing on behalf of others and illegally obtaining subsidies will also be strictly investigated. It is expected that technical and administrative measures such as strengthening the verification of vehicle owner identity and vehicle information authenticity, using big data cross comparison, and establishing integrity blacklists will be taken to ensure that subsidies truly benefit real consumers. Once identified as scalpers, not only will the subsidy qualification be cancelled for the current period, but it will also be included in the government dishonesty list and will not be entitled to any welfare subsidies for three years. Meanwhile, optimizing fund allocation may mean a more efficient review and disbursement process, as well as a more precise tilt towards consumer active areas and key promoted vehicle models, ensuring that 'good steel is used on the cutting edge'.

Although the guidance is more refined, the overall funding support for national subsidies in 2026 has not weakened. It is worth noting that in order to catch the traditional consumption peak season on New Year's Day and the Spring Festival, the state has released the first batch of ultra long term special treasury bond funds of 62.5 billion yuan to local governments in advance to support the old for new plan. This means that from January 1, 2026, consumers can enjoy the new subsidy after completing the relevant procedures, achieving a "seamless connection" of policies. This move will greatly stabilize market confidence, effectively avoid consumer wait-and-see and market volatility in the first quarter caused by policy changes, and help the car market achieve a "good start" in 2026.

02 subsidies will increase, will the car market stabilize next year?

The introduction of the new policy in 2026 is based on the solid foundation of the significant achievements of the "national subsidy" in the past two years. Looking back at 2024 and 2025, the trade in policy has become a key engine driving automobile consumption and promoting industrial upgrading. In 2024, the country will issue 150 billion yuan of ultra long term special treasury bond for the first time, which will be used to trade in old consumer goods. Automobiles are the top priority. This policy, known as the 'national subsidy', quickly ignited market enthusiasm once it was introduced. It directly reduced the cost of car replacement for consumers, especially old car owners, effectively released suppressed demand for updates, provided decisive support for the stable growth of the car market that year, and accumulated valuable experience for subsequent policy optimization. Given the successful practice in 2024, the government will decisively increase investment and double the national subsidy amount to 300 billion yuan by 2025. The unprecedented policy intensity has created a "red envelope rain" effect, which has a more significant catalytic effect on the car market.

With the increase of national subsidies, more than 11.2 million cars were driven to trade in from January to November this year, which is a milestone figure, indicating that policies have deeply penetrated the market and reached a massive number of car owners. At the same time, the national subsidy not only directly promotes automobile sales, but also drives the consumption of related goods and services by over 2.5 trillion yuan through the industrial chain, benefiting more than 360 million people, highlighting the pillar role of automobile consumption in the macro economy. At the same time, under policy incentives, the proportion of new energy vehicles being exchanged for old ones continues to increase, accelerating the replacement of the existing fuel vehicle market and the green transformation of the entire transportation system. Two years of practice have fully proved that the "trade in" subsidy is an excellent policy tool that directly meets demand, has a rapid effect, and has a significant multiplier effect. It not only stimulates consumption and promotes circulation at the economic level, but also helps improve energy conservation, emission reduction, and traffic safety at the social level. It accelerates technological progress and capacity optimization at the industrial level.

Therefore, standing on the shoulders of the high base in the previous two years, the 2026 national subsidy policy shoulders a new mission. It is no longer simply about stimulating sales, but about precisely guiding structure and improving quality. Through differentiated subsidy design, the policy signal is crystal clear: encouraging consumers to pursue cars of higher quality and technological content, and driving car companies to shift their competitive focus from price wars to value wars. With the early arrival of the first batch of 62.5 billion funds and the simultaneous fall of regulatory iron fisted measures, a more standardized, transparent, and efficient subsidy implementation environment is taking shape. It can be foreseen that the Chinese car market in 2026, under the protection of the new national subsidy policy, is expected to bid farewell to the ups and downs and move towards a prosperous situation characterized by technological upgrading, brand improvement, and consumer quality enhancement. The new development cycle of the car market has quietly begun with the release of the new policy.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!