Scan QRCode

Chinese cars are no longer "peripheral players" in the European market, but have truly entered the mainstream competition track, even forcing the EU to initiate major adjustments to its automotive industry policies. According to foreign media reports, by the end of this year, the number of cars imported by the European Union from China may exceed its exports to China for the first time. For the EU, this means that there will be a trade "deficit" in China Europe automobile trade. For Europe, which used to occupy the top of the global automotive industry pyramid for a long time and take pride in technology output and trade surplus, this transformation is undoubtedly an "industry earthquake".

Image source: Official website of the European Commission

Under pressure, on December 16th local time, the European Commission officially announced the withdrawal of the original plan to completely ban the sale of new fuel vehicles from 2035, and replaced it with a more flexible emission reduction plan. According to the new proposal, car companies need to reduce the average carbon dioxide emissions of new cars by 90% compared to the 2021 benchmark by 2035.

Image source: Chebaihui Research Institute

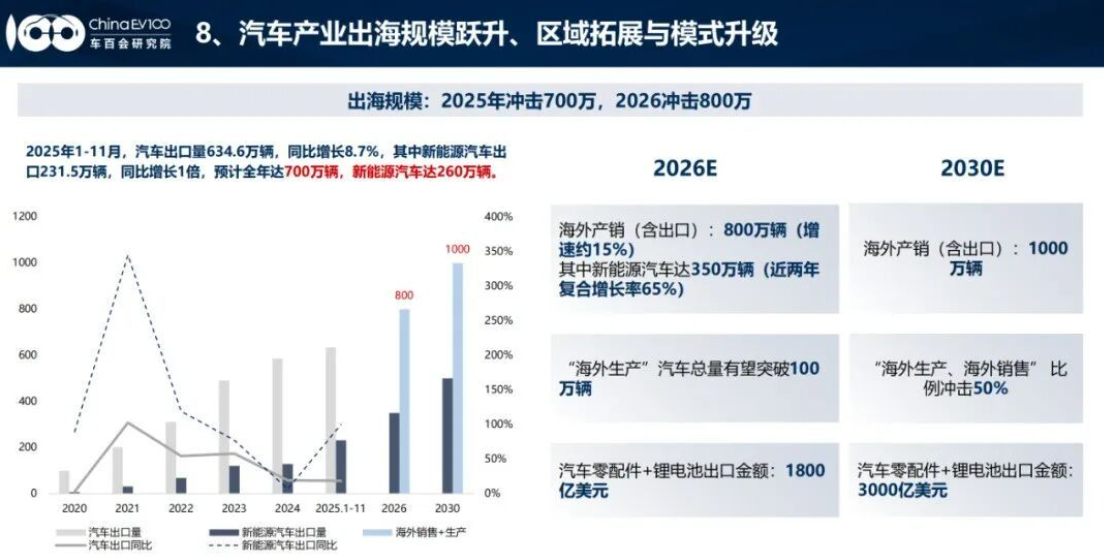

According to data from Chebaihui Research Institute, Europe has become the core export market for Chinese automobiles. The European automotive industry cannot do without the Chinese automotive industry, especially in the intelligent stage, "said Zhang Yongwei, Chairman of the China Automotive Industry Association, in an interview with China Newsweek." The automotive industry is one of the pillar industries in Europe, and China's automotive industry needs to achieve win-win cooperation with the European Union in the process of going global. The EU has shown a high willingness to cooperate in the fields of electrification and intelligence, and we should seize this opportunity

China Europe Automotive, easy to attack and defend

As the cradle of the automotive industry, Europe has always been an export market for automotive products and technologies, delivering advanced products and technologies to various parts of the world and occupying a position of trade surplus. Just three years ago in 2022, Europe still had a surplus of 15 billion euros in car exports to China. However, this situation will reverse in 2025. According to foreign media reports, China Europe automobile trade is expected to experience its first deficit in 2025, with the EU's imports of automobiles from China expected to exceed exports by 2.3 billion euros (approximately 19.09 billion yuan). Behind the numbers lies the reshuffling of the global automotive industry under the wave of the new energy revolution. While traditional European car giants are still refining their internal combustion engine technology and hesitating to transition to new energy, Chinese car companies have keenly seized the historical opportunity. Under policy support, capital investment, technological innovation, and market cultivation, China's new energy vehicle industry has achieved leapfrog development. Laurent Corbett, a senior executive of a French electronics company, made a representative choice by locking the new company's car in the Chinese brand BYD, citing that "there is no comparable model in the same price range". He said, "BYD's plug-in hybrid model has a range of 870 kilometers and is priced at 44500 euros. Both in terms of appearance and range, it is more competitive in its class." Zhang Yongwei bluntly stated that accurately grasping the needs of young consumer groups is one of the core advantages of Chinese car companies. Intelligent cars have not only conquered young people in China, but are also capturing the hearts of young people in Europe, laying a solid market foundation for Chinese cars to go global. It's not just about exporting complete vehicles. German car companies such as Volkswagen, BMW, and Mercedes Benz are increasingly purchasing Chinese components or partnering with Chinese intelligent solution suppliers. On the one hand, the reason is that Chinese component companies have continuously narrowed the gap in product quality with German companies through industrial upgrading; On the other hand, intelligent and electric solutions from Chinese companies have advantages that European car companies cannot refuse in terms of technology and cost. From complete vehicles to components, the Chinese automotive industry is penetrating the European market in all aspects.

EU Policy Turn

The significant adjustment of the EU's automobile emission reduction policy this time is not a momentary impulse. Looking back at the evolution of policies, it is not difficult to see the struggles and compromises of the European automotive industry. In 2021, the European Commission proposed for the first time the radical goal of a complete ban on the sale of new fuel vehicles by 2035, attempting to force the automotive industry to transition towards electrification through policies and causing a global shock in the automotive industry. In February 2023, the European Parliament passed a zero emissions agreement with 340 votes in favor, 279 votes against, and 21 abstentions, specifying that new cars sold by 2035 must achieve zero emissions; In March of the same year, under pressure from traditional automotive industry powerhouses such as Germany and Italy, the European Union made its first compromise by opening up exemption channels for internal combustion engine vehicles using synthetic fuels through amendments. Now, the latest plan released by the European Commission is much more lenient than market expectations: unlike the previous rule that only exempted synthetic fuel vehicles, this time the core requirement is directly relaxed from "100% zero emissions" to "new vehicles reduce emissions by 90% compared to the 2021 benchmark value". The remaining 10% emission gap can be offset by using low-carbon steel, synthetic fuels, or non food biofuels produced by the European Union. This means that plug-in hybrid vehicles, extended range hybrid vehicles, hybrid electric vehicles, and even traditional fuel vehicles can all be allowed to stay in the market after 2035 through various emission reduction measures, which is equivalent to giving up the ban on fuel engine technology. In fact, European car companies such as Volkswagen Group and Stellantis have previously stated that demand for electric vehicles is weak. They are calling on the EU to relax carbon emission targets and reduce fines for non compliant car companies. The European Automobile Manufacturers Association stated that the current moment can be considered a "life and death crisis" for the European automotive industry. William Todts, Executive Director of Transport and Environment (T&E), an advocacy group for clean transportation, said that the EU is delaying time while China is accelerating: "Relying on internal combustion engines will not make European car manufacturers great again

Breakthrough and Win Win

Faced with the strong rise of Chinese car brands in the European market, local European companies are stepping up their efforts to build a defensive line and try to hold their market position. Recently, French car company Renault and American car giant Ford announced plans to jointly develop mid to low end electric vehicles for the European market in an attempt to reduce development costs. At the same time, the French Automotive Supplier Industry Liaison Committee (CLIFA) has publicly called for the introduction of higher threshold localization policies, proposing strict standards that the localization rate of complete vehicles should be increased to 80% and the local content of spare parts should not be less than 70%, with the intention of using policy barriers to weaken the market competitiveness of Chinese automobiles. Europe has globally leading strict requirements for data protection, especially GDPR (General Data Protection Regulation). In addition, there are specific requirements for the processing of vehicle networking data related to network security (such as the NIS2 directive) and possible future AI Acts. Zhang Yongwei revealed that top domestic smart driving companies have launched targeted multi version compliance solutions, "neither sacrificing the functionality of smart driving nor being unable to board the vehicle due to non-compliance with standards. I think this is a gradual process. But it is not a roadblock that cannot be stopped. It is worth noting that the EU Carbon Border Adjustment Mechanism (CBAM) will officially come into effect in 2026, and cars exported to the EU will be required to fully declare their full lifecycle carbon emissions data. Starting from 2030, corresponding taxes and fees will be paid based on emissions. According to the export scale in 2024, the annual tax and fee may exceed 370 billion yuan. The changes in the industrial environment are also intensifying competitive pressure. With the global demand for energy storage batteries recovering, battery prices may rebound in 2026, which is a major constraint on profit growth for new energy vehicle companies that heavily rely on battery cost advantages. In addition, the shortcomings in brand and service are still one of the factors restricting some Chinese cars from going global. At present, some car companies are still in the stage of "price for quantity" product output, with insufficient coverage of overseas after-sales service outlets and lagging construction of localized service systems. Their brand awareness and premium ability are still inferior to traditional European car companies. The transformation from "cost-effectiveness output" to "technology and brand value output" still requires a long period of market cultivation and reputation accumulation. According to data from the Chebaihui Research Institute, Europe is an important incremental market for high-value new energy vehicle models. However, due to tariff policies and carbon border adjustment mechanisms, the growth rate of vehicle exports has slowed down and shifted towards "building factories+cooperative production" to replace pure exports. Zhang Yongwei believes that the automotive industry is a pillar industry of the European Union, which is related to employment, people's livelihood, and economic foundation. In his opinion, on the one hand, we need to continue to export more electric and intelligent products to the European market to meet the demand of local consumers for high-quality new energy vehicles; On the other hand, it is even more important to consider how to achieve mutual benefit and win-win outcomes for the China Europe automotive industry in the context of globalization.

Image source: Chebaihui Research Institute

Despite numerous challenges, the industry still has ample confidence for long-term growth. Zhang Yongwei predicts that the scale of China's automobile exports is expected to exceed 10 million units in the future, with new energy vehicles taking the lead. And those car companies that can both consolidate their domestic market fundamentals and build technological, brand, and service barriers in global competition will eventually stand firm and achieve sustainable development in this wave of global automotive industry transformation.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!