Scan QRCode

In 2025, the Chinese SUV market is undergoing an unprecedented restructuring driven by the dual forces of the new energy wave and consumer demand iteration. The most distinctive feature of this year is the disruption of the previous market order, the reshuffle of top car models, and the intensification of camp differentiation. Although Tesla Model Y still holds the top spot in sales, it cannot hide the growth pressure of year-on-year decline in sales, and its former position as a benchmark for new energy is facing severe challenges; In sharp contrast, the "fuel powered duo" consisting of Geely Xingyue L and Boyue L rose against the trend and entered the top of the list with impressive sales growth, staging a strong counterattack from the fuel powered car camp. Within the new energy camp, there is a divided situation of "ice and fire": new dark horses such as the Wenjie M8 and the Zero Run C10 have successfully broken through with precise positioning and product strength breakthroughs, while many of BYD's main models have suffered sales cuts, reflecting the white hot competition in the new energy market.

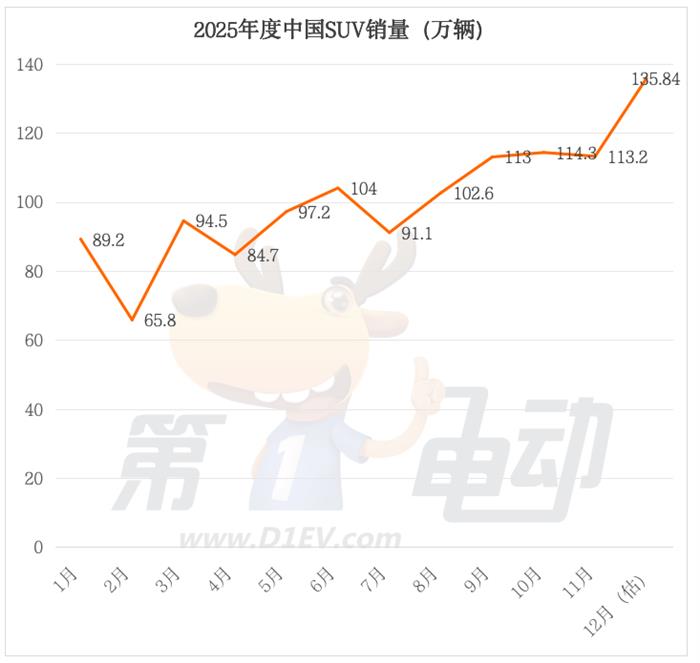

According to data from the China Association of Automobile Manufacturers, the retail sales of passenger cars in China reached 21.464 million units from January to November 2025, a year-on-year increase of 29%. Among them, the retail sales of SUV market reached 10.696 million units, accounting for nearly 50% of the total, an increase of 5.7% year-on-year. Every December, major car companies usually increase their sales efforts, with the total volume generally increasing by about 20% compared to November. Based on this, we predict the terminal sales for December by multiplying the November retail sales data by a coefficient of 1.2. It is estimated that the retail sales of passenger SUVs in China in December will be about 1.36 million units, and the total number of SUVs in 2025 will be about 12.1 million units, a year-on-year increase of about 6.6%. The estimated quantity for the top 20 SUVs in 2025 is slightly different from the retail volume disclosed in mid January next year. Please criticize and correct any inappropriate aspects.

Head pattern changes: Model Y faces pressure to defend its title, while Geely's dual fuel powerhouses counterattack

Tesla Model Y still holds the championship with an annual sales volume of about 420000 units, but the 13% year-on-year decline exposes the growth pressure it faces. As a benchmark product in the new energy SUV market, the decline in sales of Model Y is not accidental. On the one hand, the gap period between new and old car models has led to a strong wait-and-see attitude among consumers, and the delayed delivery of updated car models has further suppressed short-term demand; On the other hand, the strong encirclement of domestic new energy brands has eliminated their product strength advantages. In the price range of 200000 to 300000 yuan, many domestic models have surpassed Model Y in terms of intelligent configuration and range performance. Coupled with the gap in brand service experience, Model Y's market share has been continuously diverted. In sharp contrast to Tesla's pressure, Geely Automobile's "twin heroes counterattack". The Xingyue L and Boyue L ranked second and third on the list with sales of 258000 and 257000 units respectively, with year-on-year growth rates of 17% and 121%, becoming the absolute leaders in the fuel vehicle camp. In the market swept by the new energy wave, the outbreak of these two fuel SUVs can be called a "phenomenal level". Upon closer examination of the underlying reasons, precise pricing strategies and ultimate product strength are indispensable. The landing price of just over 160000 yuan after the Star Yue L terminal discount, combined with luxury features such as dual screens and L2 level intelligent driving assistance that are standard across the entire series, highlights the cost-effectiveness advantage; The Borui L has even raised its discounted starting price to the 90000 yuan level, targeting the compact market with the size and configuration of a mid size SUV, successfully attracting a large number of budget limited family users.

The division of camps is obvious: some people are happy and some are worried about new energy, while the backbone of fuel vehicles still exists

The new energy SUV camp is showing a significant differentiation trend in 2025. On one hand, the Wenjie M8 and the Zero Run C10 made it into the top 20 of the list with sales of about 150000 and 140000 respectively, becoming two new dark horses among the emerging forces; On the other hand, the sales of BYD's main models such as Song PLUS and Yuan PLUS have halved, with a year-on-year decline of over 50%. The Zero Run C10, with a guide price of 122800 to 142800 yuan, has achieved a superior positioning as a mid size SUV. It not only has a 2825mm long wheelbase and expandable trunk space up to 835 liters, but also fully deploys features such as the 8295 cockpit, LiDAR, and advanced intelligent driving system that were originally only available for models priced over 200000 yuan. At the same time, its dual power options of extended range and pure electric, as well as the comprehensive range of 1190 kilometers in the extended range version and the 800V high-voltage fast charging platform in the pure electric version, completely solve users' range anxiety. In just 16 months since its launch, the cumulative delivery volume has exceeded 150000 units, which confirms the huge appeal of "high-end configuration popularization" with market data. The explosion of the WENJIE M8 is attributed to its precise high-end positioning, with a price range of 359800 to 449800 yuan covering the mid to large SUV segment market. The flexible layout of 5 doors, 5 seats, and 6 seats is suitable for both home and business scenarios. Equipped with the HarmonyOS intelligent cockpit and dual motor four-wheel drive system, it combines intelligence and power performance. Within 24 hours of its release, the pure electric version received over 10000 large orders, making it the brand's undisputed sales leader. The decline in sales of BYD's models reflects the intense competition in the new energy market. As a former leader in new energy SUVs, the Song PLUS is now not only facing price shocks from fuel competitors such as Geely, but also facing product encirclement from numerous new energy brands. The lack of significant updates in the four years since the product was launched has led to a decline in freshness, coupled with the previous price war causing a dispute over the rights of old car owners. The brand value and user trust have been damaged, ultimately dragging down sales performance. In addition, Yuan UP has become a highlight of BYD's camp with a year-on-year growth rate of 45%. Its precise positioning as a small SUV and affordable price have successfully entered the urban commuting market, confirming that there are still differentiated opportunities for new energy vehicles in the segmented market. Although the fuel vehicle camp is facing overall pressure to replace new energy, the backbone is still stable. In addition to the two giants of Geely, the Volkswagen Tiguan L and Toyota RAV4 Rongfang ranked fourth and sixth on the list with sales of 205500 and 219000 respectively, with year-on-year growth rates of 20% and 13%, respectively. These joint venture fuel SUVs are still highly favored by consumers who pursue practicality and reliability, thanks to their mature power technology, stable product quality, and extensive after-sales network.

TOP20 market concentration declines, with BYD and Tesla's main vehicles under pressure

Compared to the best-selling SUV models list in China in 2024, the SUV market in China will undergo earth shaking changes in 2025. In the top 20 SUV sales list for 2025, new energy vehicles only occupy 8 seats, a decrease of 1 seat from 2024, with a cumulative sales volume of about 3.9 million units, a decrease of 6% compared to 4.15 million units in 2024. The core cause of this data change is the significant decline in sales of multiple core models under BYD. The BYD Yuan PLUS, Song PLUS DM-i, and Song Pro DM-i, which remained at the top of the list in 2024, all experienced a cliff like decline in their rankings in 2025: Yuan PLUS fell to 19th place and Song Pro fell to 11th place. Upon closer examination of the underlying reasons, one is the diversion effect brought about by BYD's internal product matrix iteration, such as the launch of the Haishi 06 directly seizing some orders from the Song series; On the other hand, the strong rise of competing car models such as Geely has also had a direct impact on its market share. The top ten "major changes" on the list are a direct reflection of the market upheaval. The Yuan PLUS, Song Pro, Toyota Fenglanda, Wenjie M7, and Ideal L6, which ranked in the top ten in 2024, all fell out of the top ten, while the Corolla RAV4, Yuan UP, Tiguan L, Tiggo 8, and Borui L successfully entered with outstanding performance. It is worth noting that among the 5 newly shortlisted models, traditional fuel vehicles occupy 4 seats, which fully confirms that fuel vehicles still have an undeniable core competitiveness in the current market and have not exited the mainstream stage due to the wave of new energy. The pattern of the bottom ten on the list is also undergoing restructuring. Former regulars such as Aion Y, Wenjie M9, Mercedes Benz GLC, and Audi Q5L unfortunately failed to make it onto the list, while Touareg, Wenjie M8, Zero Run C10, and Haval Dagou, with their precise market positioning and outstanding terminal performance, successfully entered the TOP20 list. At the level of brand ownership, the market advantage of local brands has been further consolidated. In the 2025 TOP20 list, a total of 12 models from local brands such as Geely, BYD, Changan, Chery, Haval, and Leapmotor were selected, an increase of 1 model from 2024; On the contrary, the number of joint venture brands shortlisted has been reduced from 8 to 7. However, there are also highlights among joint venture brands, with the Toyota RAV4 showing particularly outstanding performance, jumping from 8th place in 2024 to 4th place in 2025, becoming the "top seedling" among joint venture brands with a sales volume of 219000 units; Although classic joint venture models such as Honda CR-V and Volkswagen Tiguan L barely made it onto the list, their sales have all experienced varying degrees of decline, and their market competitiveness continues to weaken. Compared to two years of sales data, the Chinese SUV market is showing three significant trends. Firstly, although the process of new energy transformation continues to advance, there is still a stable market for fuel/hybrid vehicles. In the 2025 ranking, although new energy vehicles still occupy an important position, the rise of hybrid/fuel vehicles such as the Star Yue L and Bo Yue L proves that there is still a huge demand for hybrid vehicles that balance economy and convenience in the context of incomplete charging facilities and incomplete range anxiety. Especially in third - and fourth tier cities and long-distance travel scenarios, the advantages of fuel/hybrid models are still evident. Secondly, mid to large sized SUVs and family scenario models have become the new focus of competition. With the increasing number of families with multiple children, the diversified demand for family travel is driving car companies to accelerate their layout in segmented markets. Models such as the Wenjie M7, M8, Ideal i8, and Zero Run C16 have been launched one after another, featuring large space, multi seat layout, and intelligent configuration to meet the travel needs of families with multiple children. Thirdly, intelligence and cost-effectiveness have become core competitive factors. The success of the Zero Run C10 confirms this trend - it is equipped with high-end configurations such as Qualcomm SA8295P flagship chip and LiDAR in the 130000 price range, achieving a breakthrough in "affordable high-end" and accurately hitting the pain points of young consumers' needs. The 2025 China SUV bestseller list is not only a summary of market competition in the past year, but also an inspiration for the future development of the industry. Fuel vehicles did not exit as quickly as expected, but instead held their ground with precise product positioning and technological upgrades; New energy vehicle models are accelerating their reshuffling in fierce competition, and only brands with core technology and ultimate product strength can stand out. The year 2026 is approaching, and with the continuous hot sales of "new dark horses" such as Xiaomi YU7, all-new WENJIE M7, Sea Lion 06, and Titanium 7, they will become the core force that changes the SUV market in 2026.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!