Scan QRCode

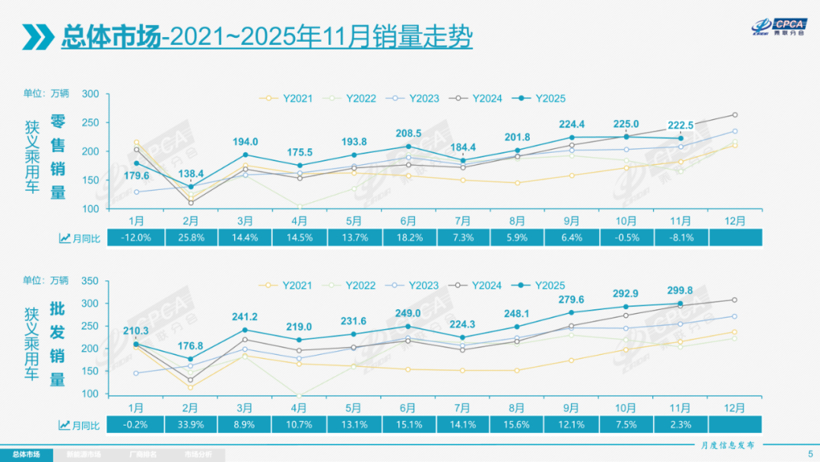

Never mind, I won't buy anymore! "My friend Lao Zhou has been struggling recently. He had been driving the Baojun 560 for nine years and was already covered in wind and frost. He had planned to replace it with a Geely Galaxy M9 worth 216800 yuan by the end of the year, fulfilling his dream of a "large space family car". After careful consideration, he still pressed the pause button on his car purchase plan. Old Zhou, born in the 1980s, is doing some engineering business in the Sichuan Chongqing region. In the past two years, the business has been sluggish, the amount of engineering has sharply decreased, and the household income has visibly shrunk. What makes him even more hesitant is the car trade in policy. By the fourth quarter of this year, subsidies will have to rely on lottery, and whether he can get them depends entirely on luck. Not being able to shake the number is equivalent to losing over 10000 yuan. Perhaps there will be other good policies next year, and buying late will definitely enjoy discounts. "Lao Zhou's concerns are not isolated, and his hesitation is like a microcosm of the current Chinese car market: policy dividends are at their peak, consumer confidence is insufficient, and the previous year's" tail lifting rush "has completely disappeared this year. The latest data from the China Association of Automobile Manufacturers shows that the domestic passenger car retail market fell by 8% year-on-year in November, marking the second consecutive month of year-on-year decline in the fourth quarter. This rare trend has cast a pessimistic shadow over the car market in 2026. The subsidy of 01400 billion yuan could not break the tail raising market. "In the past, November and December were the peak season of the car market, and dealers were too busy to touch the ground, but this year was particularly quiet." In Shanghai, the sales manager of a joint venture brand 4S store complained about the general feeling of the industry. The data released by the China Association of Automobile Manufacturers on December 8th also confirms this point. From September to November, the domestic passenger car market showed a rare sideways trend, with a year-on-year decline of -8% in November, breaking the trend of year-end consumption warming for many years. The retail market growth rate in the first 11 months was only about 6%.

Cui Dongshu, Secretary General of the China Association of Automobile Manufacturers, frankly stated that this kind of year-end "overheating" is extremely rare in the history of the industry. According to common sense, the deadline for the reduction of purchase tax incentives for new energy vehicles is approaching, and consumers will seize the last window to buy cars. Coupled with the discount offered by dealers at the end of the year to boost performance, the car market should have welcomed a wave of car buying enthusiasm, but reality has not yet emerged. Entering December, industry feedback indicates that the market performance in the first week remained lackluster. The industry generally predicts that there may be a continued year-on-year decline in December. Most of the time, car companies will hide some of their December sales for January next year. Considering the generally pessimistic predictions about next year's market, especially in the first quarter, the data for December is unlikely to look good, "said an industry insider. Behind the downward trend of the market is the self-awareness of various car companies, especially the growth slowdown or weakness of top car companies, which is more representative. For example, as the leader of domestic car companies, BYD has shown signs of weakness since September this year. In the past three months, sales have declined by -5.5%, -12%, and -5% year-on-year, respectively, and this data was obtained against the backdrop of a 300% surge in overseas sales providing solid support. Including Geely and Xiaomi, the former's sales growth continues to narrow, while the latter has seen a rare occurrence of in stock car purchases due to mass market buying. This is the case for these leading car companies, and the situation for other domestic car companies may be even more pessimistic.

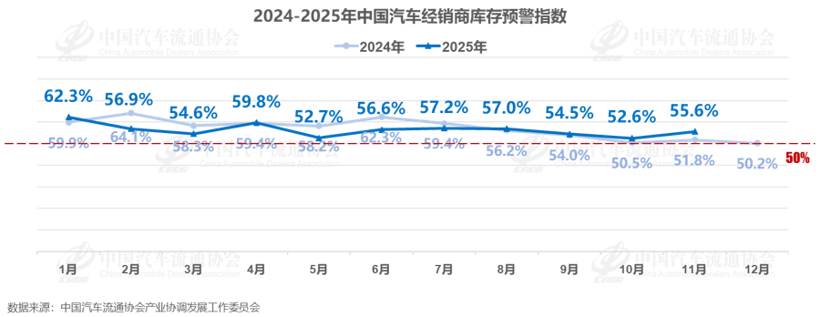

The chill at the end of the canal is also very obvious. In November, the inventory warning index of car dealers soared to a high point of 55.6% for the year, with a total inventory of over 3.3 million vehicles nationwide. 43.6% of dealers experienced a price inversion of more than 15%, selling one car at a loss, which has become the norm for many small and medium-sized dealers. The contrast of "busy production, beautiful data, and cold retail" further confirms the reality of the early winter in the automotive market. Based on this industry trend and situation, it is predicted that the domestic car market may experience a rare three consecutive year-on-year decline in the fourth quarter of this year, with an overall growth rate of around 5% for the whole year. Why does the upturned tail disappear? The core is strong policies that have a significant impact on the regular consumption cycle of automobiles. In other words, the conventional year-end upturn in the car market is not absent, but rather advanced to the first few months and overdrawn. Against the backdrop of a downturn in various industries, the country has put in a lot of effort to boost automobile consumption and stabilize the car market. According to the China Association of Automobile Manufacturers, policies such as preferential purchase tax for new energy vehicles and trade in subsidies will cumulatively release nearly 400 billion yuan in dividends by 2025. The scale of trade in is expected to exceed 180 billion yuan, and more than 200 billion yuan of vehicle purchase tax corresponding to over 2 trillion yuan in sales of new energy vehicles will be reduced or exempted. Under the temptation of so much "wool", in addition to encouraging consumers who are preparing to change cars to actively invest in car consumption, a considerable number of consumers who plan to change cars in the next one to two years have also advanced their plans. Data shows that in the first 11 months of 2025, the overall sales of domestic automobiles will be close to 30 million units, with over 11.2 million units traded in, accounting for more than one-third of the total sales. This means that a policy investment of 400 billion yuan has stimulated one-third of the market's sales contribution, but the final increase may only be maintained at 5%. The "inefficiency" behind this contrasting data precisely indicates that the stimulating effect of automobile consumption is diminishing marginally. The viewpoint of analysts in the Da Mo automobile industry is sharper. Excluding the contributions of exports and the "two new" policy (new energy+trade in "), domestic electric vehicle sales have already experienced a 5% -6% decline since 2024. Although the decline narrowed to 3% -4% in 2025, the essence of" policy support "has not changed - although the current market has been maintained, this" flood of stimulus "has consumed the replacement demand in the next 1-2 years ahead of schedule, and the replacement market is likely to" shut down "in 2026. 02 decline is inevitable, how much will it fall? Will the car market fall in 2026? At present, there are several viewpoints in the industry. For example, at the 2025 annual meeting of the China Automobile Dealers Association in early November, experts from various fields predicted that if the country continues to introduce consumer policies, the car market will slightly increase by 1% to 3% next year, and the worst case scenario is to remain flat. But some insiders admitted that the optimistic tone is to stabilize industry confidence, and the actual forecast is negative growth. Another viewpoint holds that the decline is already predetermined, and the controversy only lies in "how much it will fall". After all, with this round of strong policy overdrafts and the tight finances of the country and various regions, it is almost impossible to continue providing huge subsidies. A few days ago, UBS issued a warning, predicting that the Chinese passenger car market will experience a negative growth of 2% in 2026; At the 2nd China International Lithium Industry Conference in November, Cui Dongshu stated that the passenger car market sales are expected to reach 23.8 million units in 2026, a year-on-year decrease of 2.1%. The forecast data from analysts in the Da Mo automotive industry will be relatively more brutal. Especially according to the stimulus policies for automobile consumption from 2008 to 2009 or 2015 to 2017, which led to a pullback in the upward cycle, they predict that the domestic passenger car market is likely to experience a decline of 6% to 8% in 2026. Having a better understanding of the perception of frontline car sales executives towards the car market may be more accurate. During last month's Guangzhou Auto Show, most automakers had a more pessimistic forecast, generally believing that the negative growth rate could approach 10%, with the worst-case scenario being a 20% drop in the first quarter. The 45 day sales window from New Year's Day to Spring Festival, followed closely by March after the Spring Festival, is already a traditional off-season, and the core sales contribution basically depends on the 45 days before the Spring Festival. If there is no policy support, coupled with last year's high base, a pessimistic forecast of a 20% decline is not impossible. "Industry insiders analyze that" negative growth "has become the industry's default" bottom line consensus ", and the cold winter of the car market in 2026 has become a certainty. Behind this difficult to reverse downward trend is the concentrated outbreak of multiple pressures such as costs, demand, production capacity, and competition. The first and foremost issue is the aftermath of policy overdrafts on the demand side. By 2025, the ten million level trade in program will have depleted the demand for trade in ahead of schedule. Entering the fourth quarter, the subsidy for trade in programs across the country has been suspended due to budget exhaustion, and cities like Chongqing are still having a lottery for subsidies. For users like Lao Zhou who want to trade in, they simply choose to "wait and see".

After the reduction of the purchase tax on new energy vehicles in 2026, consumers of low-priced models below 150000 yuan will be more sensitive to costs. According to the prediction from Minmetals Securities, the growth rate of new energy passenger vehicles will sharply drop from 27% in 2025 to 15% in 2026, bidding farewell to the era of high growth. Secondly, there is cost pressure. In October 2025, the profit margin of the automotive industry has dropped to 3.9%, the lowest in the same period of five years, and car companies are already overwhelmed. From the situation of major car companies in the first three quarters of this year, the situation is not optimistic. About half of domestic car companies have negative profits, and multinational car companies have generally encountered a "dark third quarter". At a time when profits are under pressure, upstream raw materials are experiencing a "black swan" event. Since June 2025, the price of lithium carbonate has risen from 60000 yuan/ton to 100000 yuan/ton in November, reaching a new high in a year and a half. As a core raw material for new energy vehicles, the price increase of lithium carbonate directly drives up the cost of power batteries, and car companies have limited say in battery suppliers and can only passively accept it. If raw material prices rise in 2026, it will inevitably affect the cost and pricing system of car companies. Either car companies can withstand losses, or terminal prices will increase. But either choice will further suppress demand. In addition, the total production capacity of China's automotive industry in 2024 is about 48.7 million vehicles, while the sales volume that year was only 31.43 million vehicles, and the 64% capacity utilization rate is far below the healthy level. This year, Geely Automobile's acquisition of SAIC GM Shenyang Beisheng Factory and Changan's acquisition of Beijing Hyundai Chongqing Base are a microcosm of overcapacity. From a competitive perspective, there are more and more new products, and every market is a red ocean competition. With a decline in demand in 2026, car companies are likely to restart price wars in order to survive, further squeezing the survival space of small and medium-sized enterprises. 'Either be merged or exit the market' has become the fate of many weak brands.

03 Winter reshuffle, the breakthrough and rebirth of Chinese automobiles

However, under the overall downward trend, the car market is not without bright spots. Domestic retail will experience a decline, but from a wholesale perspective, growth is also a probable event, and structural opportunities for Chinese automobiles are emerging. For example, the export market will become an important growth engine, and domestic automobile exports are expected to approach 7 million units by 2025, with this number steadily increasing by 2026. BYD has set a sales target of 1.5-1.6 million vehicles for overseas markets by 2026, with a year-on-year increase of about 70%; Geely, Chery, Changan and other car companies are accelerating their localization production overseas and expanding their market share through technology exchange; New energy brands are also stepping up their efforts to expand overseas, with overseas factories and localized operations becoming a consensus. Despite facing challenges such as trade protectionism, the industrial chain advantage of China's new energy vehicles will still support the resilience of the export market.

The switch in the technology track will also inject new vitality into the industry. For example, Robotaxi and embodied intelligence are becoming the next stop for car companies to compete. With the gradual clarification of L3/L4 level autonomous driving regulations and the decrease in hardware costs, there is a possibility of accelerated expansion of commercial pilot projects in 2026. In addition, Xiaopeng has released robots, laid out low altitude economy, and ideally launched AI glasses. Car companies are expanding their competitive dimension through cross-border integration. The deep binding of AI technology with the automotive industry can attract high net worth users, break out of the "price competition", and also stimulate new product forms and business models. In addition, the competition logic in the industry is also undergoing changes. After the national "anti involution" measures were introduced in the second half of 2025, car companies have begun to shift from "price reduction" to "value enhancement" - for example, downgrading the laser radar and fast charging functions of high-end models to mainstream models, and changing "optional to standard" configurations; At the same time, accelerate the iteration of new products, shorten the lifecycle of vehicle models, and avoid the rapid depreciation of old cars. This kind of 'value competition' not only enhances user experience, but also shifts the industry from 'quantity increase' to 'quality change', paving the way for long-term development.

Before the Great Reign, there must be great chaos, and chaos is the dawn and darkness that must be passed before rise. The cold winter of 2026 is both a survival test and an opportunity for transformation. Enterprises that rely on policy dividends, lack core technologies, and are addicted to price wars are likely to be eliminated in the cold winter; Enterprises that focus on technological innovation, deeply cultivate overseas markets, and build differentiated advantages will seize the opportunity in the reshuffle. BYD's overseas acceleration, Geely's technological investment, and the cross-border exploration of new forces all indicate that China's automotive industry is bidding farewell to the old era of scale expansion and moving towards a new stage of high-quality development. For consumers, short-term market fluctuations mean more room for observation, but in the long run, industry transformation will bring higher quality, smarter, and more cost-effective products. For the Chinese automotive industry, this cold winter is a necessary path. Only by experiencing the baptism of capacity clearing, technological iteration, and global competition can Chinese cars truly shake off the label of "big but not strong" and grow into the core force of the global automotive market.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!