Scan QRCode

Chery, the “long-distance running champion”, has finally achieved its wish and rang the bell to list on the Hong Kong Stock Exchange. As always, it has kept a low profile without any large-scale publicity, but it can hardly hide the restless heart of this automobile enterprise based in Wuhu, Anhui. Besides demonstrating its own value, the listing is also for survival. For an automobile enterprise that hopes to develop in the long run, listing is an inevitable fate. And Chery is not the only one that wants to demonstrate its value and survive.

Chery has completed a long run and is listed on the Hong Kong Stock Exchange. Chairman Yin Tongyue and the leaders of Wuhu City jointly sounded the bronze bell for the listing, and they waited for 21 years for this moment. From the continuous failure of shell listing to gradually breaking through the mixed ownership reform dilemma and catching up with the trend of new energy, Yin Tongyue, who is over sixty years old, led Chery to its peak.

Chery, the data on the books is beautiful. In 2024, Chery's export volume was 1.14 million vehicles, ranking first in Chinese brand passenger car exports for 22 consecutive years. It will continue to climb in 2025 and, barring any unforeseen circumstances, remain the top exporter; According to the previous prospectus, Chery's revenue increased from 92.618 billion yuan to 269.897 billion yuan from 2022 to 2024, and its net profit increased from 5.806 billion yuan to 14.334 billion yuan.

The capital market is not just about looking at book data. In recent years, in order to promote the development of new energy vehicles, Chery has been intensively promoting new cars in a bulk manner, with large volumes and multiple models, but overall lacks strength and support from popular models, which is a drawback of Chery. Whether domestically or overseas, Chery is highly dependent on fuel vehicles, with a low price bottleneck that has not been overcome and slow progress in high-end business. Restart Fengyun QQ、 Old brands such as Weilin have stirred up a wave of emotions, but there is still more room for imagination to extend their lifespan.

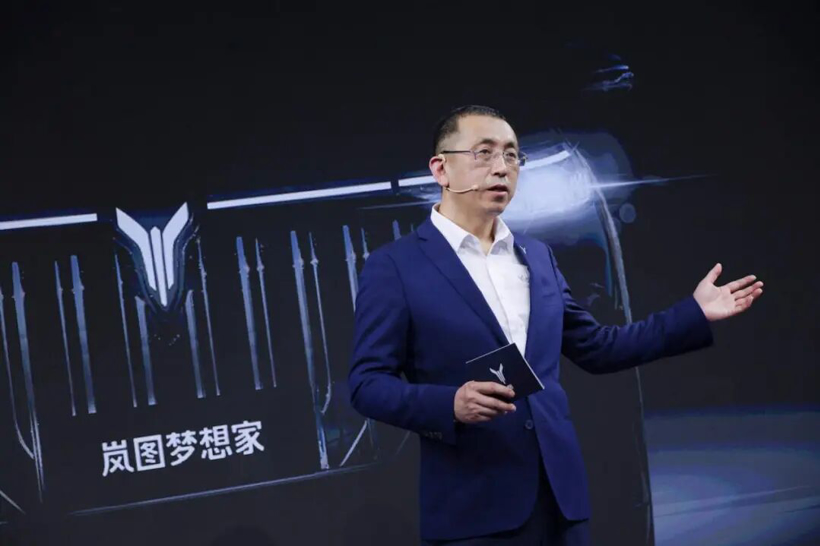

On the eve of Chery's listing, a car company located in Wuhan made frequent moves in order to be listed on the Hong Kong stock market. On September 22nd, Lantu Automobile underwent a major personnel adjustment, with the legal representative and chairman changed from You Zheng to Lu Fang. This is a key measure taken by Lantu Automobile to sprint for listing on the Hong Kong stock market. Previously, Dongfeng Group planned to privatize and delist, and ultimately allowed Lantu Automobile to go public through an "introduction listing" approach. The entire group is paving the way, and in this battle of Lantu Automobile, we can only win and not lose.

Under the leadership of Lu Fang, Lantu Automobile, which has been promoted for many years, can indeed be regarded as a high-quality asset of Dongfeng Group. Compared to other independent brands of Dongfeng Group, Lantu Automobile has embarked on its own new energy path, and most importantly, its high-end attributes have begun to emerge. Taking the MPV Dreamer as an example, a model priced over 300000 yuan has consistently performed well in the market and holds a significant voice in its segmented market. However, there are shortcomings. Under the pressure of sales, the new cars launched by Lantu Motors in the future are priced lower, and the lowest priced Lantu Zhiyin sells more than a thousand units per month, which is relatively sluggish.

In the future, Lantu Automobile will launch a new car with a higher positioning. Will the result be similar to that of Wanjie, where the higher the price, the better the sales? It's hard to say. Having high-end attributes, its models are uneven, and its market performance is even polarized. The monthly sales of the entire brand exceed 10000 vehicles, which is not enough to support long-term development - Lantu's book data needs to be even more beautiful to emulate Chery.

One mountain cannot accommodate two kings. After Wang Xiaofei was transferred to the position of Executive Vice President of Changan Ford, Wang Hui came on as a substitute, and this substitute was not simple. He directly replaced Zhu Huarong as the Chairman of Avita Technology. According to the introduction, Wang Hui was a hero in the construction of Chang'an Luoyong Factory, and his years of overseas business experience were the main reason why he was able to take charge of Avita. Of course, there is something even more important - Avita plans to go public independently.

It is reported that Avita is actively promoting the process of listing on the Hong Kong stock market and has entered the final preparation stage. It is expected to submit its listing application to the Hong Kong Stock Exchange as early as October. It is expected to officially submit materials in the fourth quarter of this year and plan to complete the listing in the second quarter of next year. According to the plan, Avita is expected to impact global sales of 400000 vehicles by 2027, achieving a revenue of billions annually. The longer-term goal is to expand to 80 countries by 2030, achieve annual sales of 800000 vehicles by 2030, and challenge annual sales of 1.5 million vehicles by 2035. Extending the goal to 10 years at once, although we don't know how the market will change at that time, Avita's ambition lies here.

Returning to reality, Avita's cumulative sales in the first half of 2025 were 59100 vehicles, achieving 27% of the target of 220000 vehicles. The cumulative sales from January to August were 79800 vehicles. To achieve the target, a total of 140000 vehicles need to be reached in the remaining four months. Even if Wang Hui takes over, such sales will still be tricky. In addition, besides planning for Avita's IPO and looking to the future, he also has one important thing to deal with: how to change the current situation of "more than enough compared to the top and more than enough compared to the bottom"? The hard truth is that both low-priced and high priced cars sell well.

Whether it is the overall listing of Chery or the independent listing of Lantu and Avita, it proves that a car company needs to rely on the capital market for long-term development. Moreover, with the gradual equalization of power between electric and gasoline vehicles, new energy is no longer favored alone, and unique technology and excellent products are needed to enter the next round of competition. All of this requires money. In addition, both Lantu and Avita are considered high-quality assets within their respective groups. For many people in the group, it is particularly important whether these high-quality assets can give the group a breath of life after going public.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!