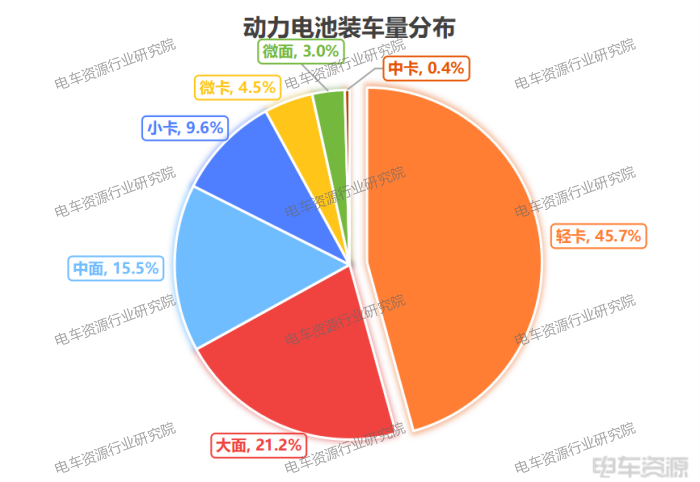

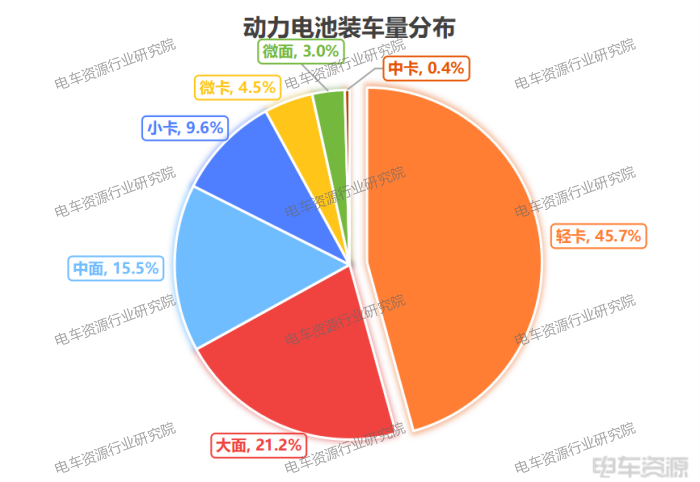

According to the latest data statistics from the Industry Research Institute of Tram Resources, in August, the total installed capacity of power batteries in the new energy logistics vehicle market was 3.7 GWh, a month-on-month increase of 14.3%. Among them, light trucks accounted for 45.7% of the installed capacity, large vans accounted for 21.2%, and medium vans accounted for 15.5%. From January to August, the cumulative installed capacity was 22.9 GWh.

Data description: The data source is vehicle insurance registration data. The information on battery enterprises and battery capacity comes from the new vehicle announcements/tax exemption lists for vehicle purchase tax reduction. In cases where multiple battery enterprises' products are optional, the data is evenly distributed according to the number of optional enterprises. The output is manually processed by the Industry Research Institute of Electric Vehicle Resources.

Top 10 battery loading volumes in August | The competition among Gotion, EVE and AVIC is fierce

CATL ranked first in battery loading volume in August with 2077.5 MWh, a month - on - month increase of 21.5%, accounting for 56.3%, and continued to lead the market. Gotion High - tech ranked second with a loading volume of 382.3 MWh, a month - on - month decrease of 3.9%, accounting for 10.4%. EVE Energy showed a remarkable performance with a loading volume of 339.3 MWh, a month - on - month increase of 4.6%, accounting for 9.2%, and its ranking rose significantly by 1 place to the third. AVIC Lithium Battery had a loading volume of 321.1 MWh, a month - on - month decrease of 8.8%, accounting for 8.7%, and its ranking dropped by 1 place to the fourth. Fudi Battery had a loading volume of 229.0 MWh, a month - on - month increase of 11.6%, accounting for 6.2%, and its ranking remained unchanged.

From January to August, the vehicle installation volume: CATL ranked first with a vehicle installation volume of 12,656.5 MWh, accounting for as high as 55.3%, and holding an absolute dominant position in the market; Gotion High-Tech had a vehicle installation volume of 2,559.9 MWh, accounting for 11.2%, ranking second; CALB and EVE Energy had vehicle installation volumes of 2,321.4 MWh and 2,317.6 MWh respectively, both accounting for 10.1%, ranking third and fourth.

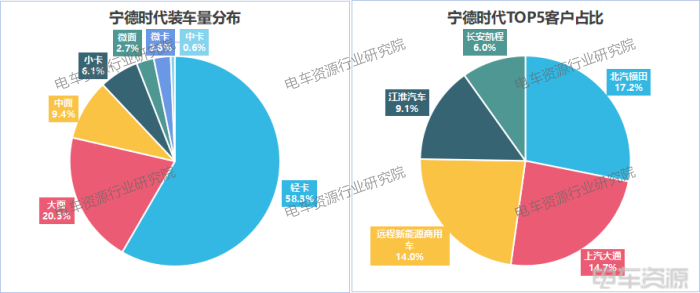

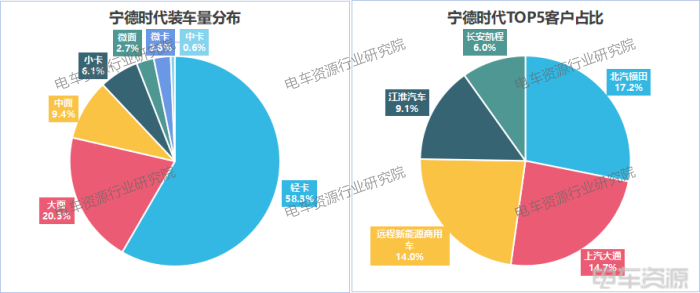

Distribution of the installed capacity of the top 5 battery enterprises. Looking at the distribution of the installed capacity of CATL, light trucks dominate absolutely with a proportion of 58.3%. Large vans and medium vans account for 20.3% and 9.4% respectively. The proportions of small trucks, mini vans, mini trucks and medium trucks are relatively low. This shows that CATL's power batteries are most widely used in the field of light truck models. At the same time, they also cover various models such as large vans and medium vans, with a wide product adaptability.

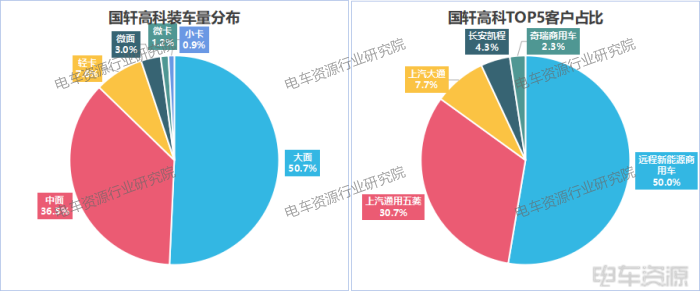

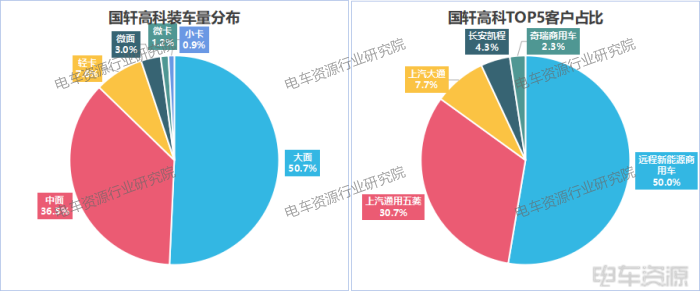

In terms of the proportion of the top 5 customers, Beiqi Foton accounts for 17.2%, SAIC Maxus accounts for 14.7%, Farizon New Energy Commercial Vehicle accounts for 14.0%, Jianghuai Automobile accounts for 9.1%, and Changan Kaicheng accounts for 6.0%. It can be seen that CATL's customers are relatively scattered and it doesn't rely excessively on a single customer. This helps to reduce the operational risks brought by customer concentration. At the same time, it also reflects that CATL has a wide customer base in the new - energy commercial vehicle field and has established cooperative relationships with many mainstream automobile manufacturers, indicating a relatively high market recognition. From the perspective of the distribution of Guoxuan High - tech's battery installation volume, large vans account for 50.7% and become the most important application model. Medium - sized vans account for 36.5%, light trucks account for 7.6%, and the proportions of mini - vans, mini - trucks and small trucks are relatively low. This shows that Guoxuan High - tech's power batteries are more concentrated in the fields of large and medium - sized vans.

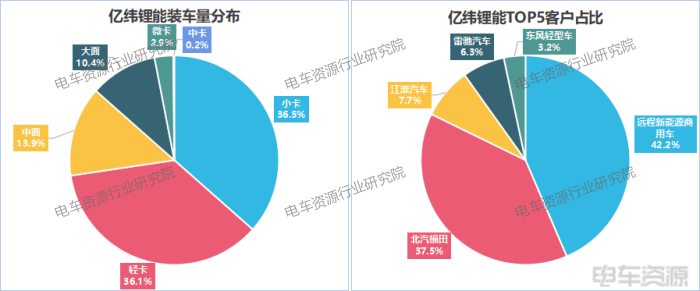

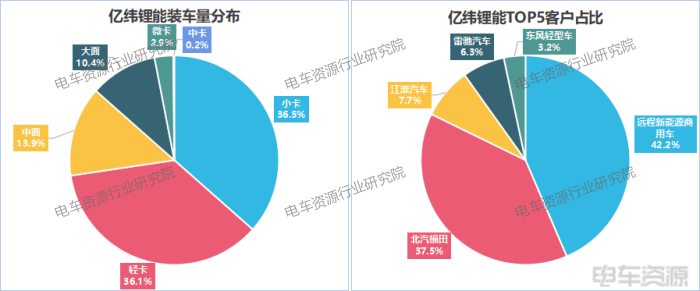

In terms of the proportion of TOP5 customers, remote new energy commercial vehicles account for as high as 50.0%, SAIC GM Wuling accounts for 30.7%, and the combined proportion of the two exceeds 80%, while SAIC Maxus, Changan Kaicheng, and Chery commercial vehicles have relatively lower proportions. From this, it can be seen that Guoxuan High tech has a high concentration of customers, with remote new energy commercial vehicles and SAIC GM Wuling as its core customers. Although this customer structure can bring relatively stable orders, it may also face certain operational risks due to changes in the needs of core customers. From the distribution of the loading volume of EVE Energy, small trucks account for 36.5%, light trucks account for 36.1%, and the two occupy the main shares, with medium and large trucks accounting for 13.9% and 10.4% respectively. The proportion of micro and medium trucks is relatively low, indicating that their power batteries are more prominent in the application of small and light truck models.

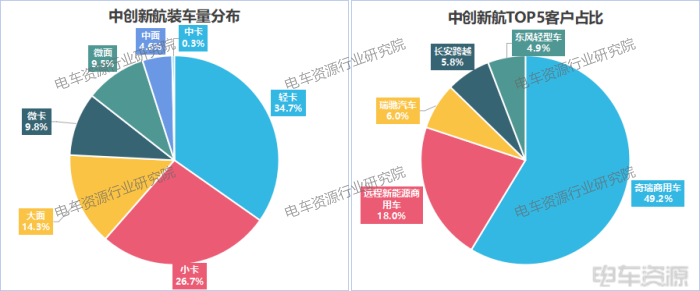

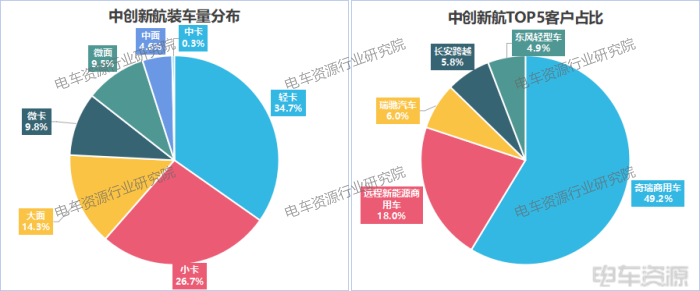

In terms of the proportion of TOP5 customers, remote new energy commercial vehicles account for 42.2%, while Beiqi Foton accounts for 37.5%, totaling nearly 80%. Jianghuai Automobile, Leichi Automobile, and Dongfeng Light Vehicle have relatively low proportions. From the distribution of loading volume, Zhongchuang Aviation's power batteries are most widely used in the field of light trucks, accounting for 34.7%; Small trucks account for 26.7%, large trucks account for 14.3%, and micro trucks, micro trucks, and other models also have a certain proportion, covering a variety of new energy logistics vehicle models with wide adaptability.

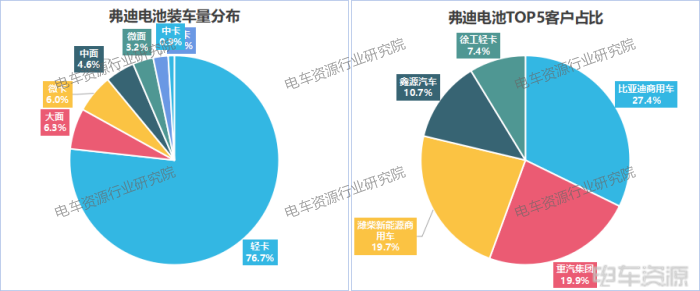

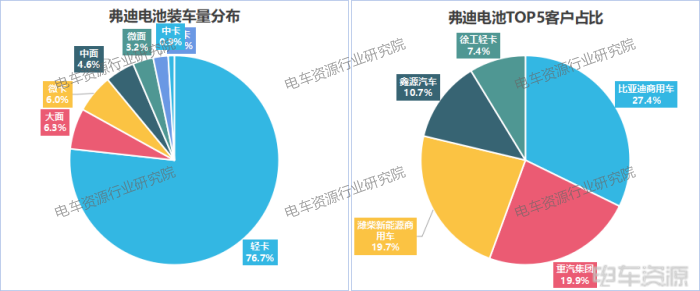

In terms of the proportion of TOP5 customers, Chery commercial vehicles account for as high as 49.2%, making them the core customers of China Innovation Airlines; The proportion of remote new energy commercial vehicles is 18.0%, while the proportion of Ruichi Automobile, Changan Guoyue, and Dongfeng light vehicles is relatively low. This customer structure shows a high degree of dependence of China Innovation Airlines on Chery commercial vehicles, while also maintaining cooperative relationships with multiple other car companies. The power battery of Fodi Battery occupies an absolute dominant position in the light truck field, accounting for 76.7%, and there is also a certain proportion of large and micro truck models, but the overall focus is on light truck models, reflecting its product advantages and market emphasis in this vehicle field.

In terms of the proportion of TOP5 customers, self supply accounts for 27.4%; Weichai New Energy Commercial Vehicles and Heavy Duty Truck Group account for 19.7% and 19.9% respectively, while Xinyuan Automobile and XCMG Light Truck also have a considerable proportion. It can be seen that the customer distribution of Fudi Battery is relatively scattered, and it has established cooperative relationships with multiple commercial vehicle companies. The stable increase in BYD's commercial vehicle sales will provide it with a stable source of orders.

English

English Chinese

Chinese